Flood Insurance: The Complete Guide

Flooding and extreme weather events in the United States are getting worse.

Three of the costliest years for climate and weather disasters occurred between 2017 and 2024, with 2005, the year of Hurricane Katrina, holding down second place.

Costliest US Weather and Climate Disasters by Year

2017 ($395.9 billion)

2005 ($268.5 billion)

2022 ($183.6 billion)

2024 ($182.7 billion)

According to Climate.gov, since 1980, “the U.S. has sustained 403 weather and climate disasters for which the individual damage costs reached or exceeded $1 billion. The cumulative cost for these 403 events exceeds $2.915 trillion.”[1]

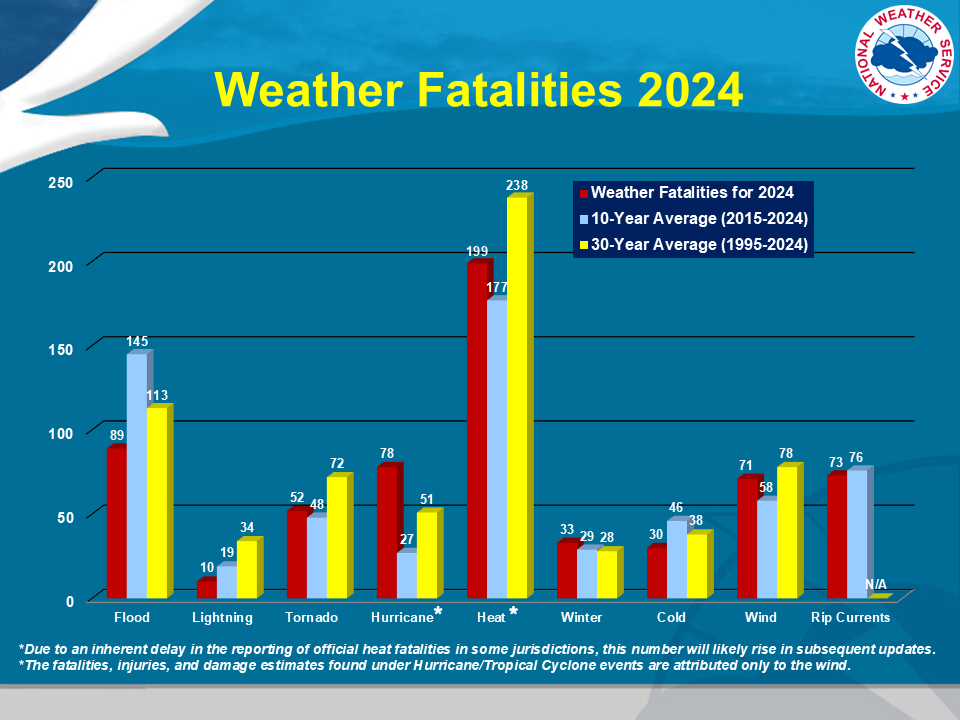

(Source: National Weather Service)

Of course, floods and other natural disasters aren’t just about dollars and cents.

Events like hurricanes, wildfires, earthquakes, and tsunamis frequently have deadly consequences for human life.

In 2024, 145 deaths were attributed directly to flooding, with 95 fatalities resulting from Hurricane Helene.[2]

As of August 2025, 141 flood deaths have already been confirmed, with 135+ in the Texas Hill Country Flood alone.[3]

With the number of devastating floods in living memory, from Hurricane Katrina to Hurricane Helene, you might be shocked to learn how many homeowners, renters, and business owners have little to no insurance coverage against flood damage.

You might even be one of them, especially if you live in an area where flooding is not traditionally high-risk.

So what exactly is flood insurance?

And do you need it?

What Is Flood Insurance?

Despite the increasing frequency and intensity of floods — particularly inland flash flooding due to extreme rainfall — only about 6% of US households carry flood insurance.[4]

Mark Friedlander, a spokesman for the Insurance Information Institute, told the Associated Press in July 2025, “Lack of flood coverage is the largest insurance gap across the country. Ninety percent of U.S. natural disasters involve flooding, and flooding can occur just about anywhere it rains.”

Standard homeowners insurance policies DO NOT cover flood damage — a fact many people find out too late.

According to FEMA, “Floods can happen anywhere — just one inch of floodwater can cause up to thousands of dollars' worth of damage… Flood insurance is a separate policy that can cover buildings, the contents in a building, or both.

The FEMA-managed National Flood Insurance Program (NFIP) offers coverage for homeowners, renters, and business owners that’s delivered through a network of 47+ private insurance companies.

NFIP Direct helps both insurance agents and policyholders navigate the process of making payments, accessing documents, and filing claims.

Who Should Get Flood Insurance?

Enrollment in the National Flood Insurance Program tends to be higher in coastal areas that have long reckoned with the devastating consequences of floods.

However, as the Texas Hill Country Flood of July 2025 shows, landlocked regions hundreds of miles from the nearest coast suffer catastrophic inland flash floods, primarily from extreme rainstorms.

Currently, over 22,000 communities in the United States are designated as Special Flood Hazard Areas (SFHA) and participate in the NFIP.

Flood insurance is mandatory to obtain a federally backed mortgage within an SFHA.

The mandatory requirement only applies to homeowners and business owners with federal mortgages, but it’s highly advisable to purchase flood insurance even if the property is fully paid off.

Renters in SFHAs are not required by law to purchase flood insurance…

The landlord is responsible for insuring the structure of the building.

However, without it, the contents of a rented property WILL NOT be covered against floodwater damage.

Any furniture, electronics, clothing, and other personal belongings damaged or destroyed in a flood will just have to be written off.

NFIP flood insurance policies for renters are typically available (and advisable) in high-risk areas.

What If You Don’t Live In an SFHA?

If you don’t live in a location currently classified as a Special Flood Hazard, that doesn’t mean you can’t get flood insurance.

Over 22,000 communities already participate in the National Flood Insurance Program, regardless of whether they contain SFHAs within their local borders.

Communities at high risk of flooding may face restrictions on federal aid and other penalties if they don’t join the NFIP.

However, even communities not currently designated as high-risk can participate if they adopt FEMA’s Floodplain Management Ordinances.

In fact, FEMA estimates that 40% of all flood claims occur in low- to moderate-risk areas.

Check if your community participates in the NFIP in the Community Status Book here.

If your community doesn’t currently participate in the NFIP, you may be able to obtain private flood insurance for your home.

What Does Flood Insurance Cover?

Most communities at moderate to high risk of flooding are enrolled in the NFIP, and it’s typically the most viable flood insurance option for renters and homeowners.

Flood insurance from private insurers can supplement NFIP coverage or substitute for NFIP (in non-NFIP communities) and varies significantly by policy.

Here’s an overview of NFIP coverage for renters, homeowners, and business owners.

National Flood Insurance Program Coverage

Policyholder Type | Building Coverage | Contents Coverage | Key Exclusions |

Renters | None. Renters do not carry building coverage – the property owner’s policy insures the building. | Yes, up to $100,000 for personal belongings (e.g. furniture, clothing, electronics, rugs, appliances). | No coverage for structure itself, vehicles, cash/valuables, or temporary housing if displaced. |

Homeowners | Yes, up to $250,000 for the home’s structure (foundation, walls, floors, electrical and plumbing systems, built-in appliances, attached garage). | Yes, up to $100,000 for personal belongings (furniture, clothing, electronics, curtains, portable appliances, washer/dryer). | No coverage for outside property (landscaping, decks, fences, pools), temporary housing, vehicles, or basement improvements / belongings. |

Business Owners | Yes, up to $500,000 for a commercial building (foundation, walls, systems, HVAC, built-in fixtures, tenant improvements). | Yes, up to $500,000 for business property (furniture, office equipment, machinery, inventory/stock). | No coverage for business interruption, outdoor property (signage, landscaping), company vehicles, cash/valuables, or basement contents. |

Feature | NFIP (Government Program) | Private Flood Insurance |

Eligibility | Available in NFIP-participating communities. Homeowners, renters, and businesses can buy coverage if their community is enrolled. | Available broadly; no NFIP community requirement. Availability varies by insurer, sometimes limited in very high-risk areas. |

Maximum Building Coverage | Residential: up to $250,000. Commercial: up to $500,000. | Higher limits available – often into the millions or full replacement cost of the building. |

Maximum Contents Coverage | Residential: up to $100,000. Commercial: up to $500,000. | Often higher than NFIP. Some policies offer replacement cost value for belongings rather than depreciated value. |

Temporary Housing (Living Expenses) | Not covered. NFIP does not pay for hotels or rental homes while your home is repaired. | Often included. Many private policies cover hotel stays or rental homes if your home is uninhabitable after a flood. |

Waiting Period | Standard 30-day waiting period before coverage begins (with limited exceptions). | Shorter waiting periods, often 7–15 days, depending on the insurer. |

Pricing Method | Rates set by FEMA using Risk Rating 2.0. Standardized pricing based on location and property details. | Market-based pricing set by insurers. Premiums vary and may be cheaper or more expensive depending on risk assessment. |

Policy Options | Basic policy with limited customization. No add-ons for living expenses or additional coverage. | Flexible policies. Options may include basement coverage, higher limits, temporary housing, or bundled coverage with homeowners insurance. |

Claims Handling | Handled by NFIP-certified adjusters. Process follows federal program rules, payouts backed by U.S. Treasury. | Handled directly by the insurer. Service and speed can vary, often faster and more personalized than NFIP. |

Accepted by Lenders | Universally accepted by all mortgage lenders to meet federal flood insurance requirements. | Accepted if coverage is at least as comprehensive as NFIP. Federal law requires lenders to accept qualifying private policies. |

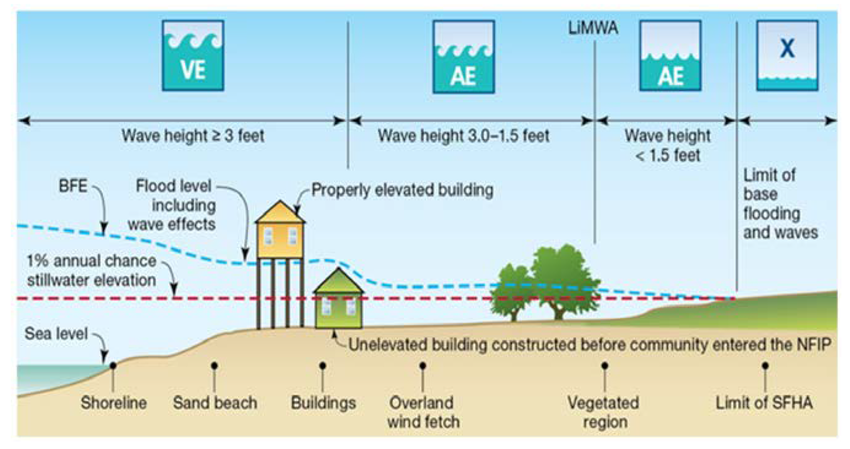

(Source: ResearchGate)

How Much Does Flood Insurance Cost?

Insurance rates through the National Flood Insurance Program vary based primarily on the following factors:

Location of the property (distance to water, flood zone designation, flood frequency)

Elevation of the building relative to Base Flood Elevation (BFE)

Type of building and foundation (one-story vs. multi-story, slab vs. basement, etc.)

Replacement cost value of the home or contents

Prior flood loss history tied to the property

On average, single-family homeowners pay between $800 and $950 annually for NFIP coverage.

The rate is significantly lower for renters to insure their belongings and the contents of their homes, as low as $100 per year.

Business owners are assessed using the same Risk 2.0 criteria as residential NFIP policyholders.

However, the government does not make average costs available, partially because there are too many variables to consider.

Industry sources suggest the following average rates for commercial properties through the NFIP.

Low-risk commercial property: $1,000–$1,500 per year for combined building & contents.

High-risk areas (Zone A, AE, V): $3,000–$10,000+ annually, depending on replacement cost, building size, and location.

Large, coastal, or repeatedly flooded businesses may face much higher premiums.

Your designated Flood Zone also significantly impacts your NFIP insurance costs.

Flood Zones and Insurance Costs

Every parcel of land in the United States is assigned a Flood Zone by FEMA, which is determined using various factors, including:

Flood elevation and Base Flood Elevation (BFE)

Proximity to rivers, coasts, or other bodies of water

Topography and land elevation relative to water sources

Types and frequency of historical flood events

Local drainage, rainfall, and storm surge patterns

Check your Flood Zone by address.

FEMA uses alphabetic codes to categorize flood risk.

FEMA Flood Zone Glossary

Flood Zone | Description |

Zone A | High-risk flood zone. No base flood elevations shown. |

Zone AE | High-risk zone with base flood elevations determined. |

Zone V | High-risk coastal flood zone subject to wave action. |

Zone VE | Coastal high-risk zone with base flood elevations and wave hazards. |

Zone AH | Areas with shallow flooding, ponding possible (usually 1–3 feet). |

Zone AO | Areas with shallow flooding, sheet flow possible (usually 1–3 feet). |

Zone AR | Areas where flood protection is being restored (levee systems under construction/repair). |

Zone X (shaded) | Moderate-risk area (0.2% annual chance flood, '500-year' floodplain). |

Zone X (unshaded) | Minimal-risk area, outside the 500-year floodplain. |

Zone D | Flood risk undetermined; analysis not performed. |

FEMA doesn’t provide average flood insurance costs based on flood zone status, but a survey of authoritative third-party publications reveals the following estimates.

Estimated Flood Insurance (NFIP) Costs by Flood Map Risk

Flood Zone Type | Average Annual NFIP Cost |

Zone X (low to moderate risk) | $768/year [30] |

Zone X (alternate data) | $786/year [28] |

High-Risk Zones (A, V, etc.) | $947–$1,607/year [27] |

Zone V (coastal high risk) | $2,324/year [29] |

Zone A | $1,015/year [29] |

Zone AE | $1,048/year [29] |

Zone AH | $657/year [29] |

Zone AO | $733/year [29] |

Zone AR | $916/year [29] |

Zone VE | $898/year [29] |

Zone D (undetermined risk) | $1,576/year [29] |

Floods and Power Outages: Be Prepared

Coastal and inland flash floods are becoming more frequent and severe in the United States.

Even inland regions that have never experienced significant flooding are at increasing risk.

One of the first casualties of flooding is often the power grid.

Extended power outages during floods are common, partially because when grid infrastructure is damaged, it’s difficult or impossible for repairs to take place until floodwaters have receded.

Evacuation orders are often issued in severe floods, but if you’re not in the center of the flood, you may be instructed to shelter in place.

EcoFlow makes a wide variety of essential home backup solutions like DELTA Pro 3 that can help keep your family safe and comfortable during blackouts, no matter what the cause.

Check out our selection today.

Resources Cited

NOAA Climate.gov. “2024: An Active Year of U.S. Billion-Dollar Weather and Climate Disasters,” January 10, 2025. https://www.climate.gov/news-features/blogs/beyond-data/2024-active-year-us-billion-dollar-weather-and-climate-disasters?

US. 2023. “Weather Related Fatality and Injury Statistics.” Weather.gov. 2023. https://www.weather.gov/hazstat.

María Méndez. 2025. “Texas Hill Country Floods: What We Know so Far.” The Texas Tribune. July 11, 2025. https://www.texastribune.org/2025/07/11/texas-hill-country-floods-what-we-know/.

https://apnews.com/author/sally-ho. “Things to Know about Flood Insurance.” AP News, July 9, 2025. https://apnews.com/article/texas-flood-insurance-fema-nfip-national-flood-insurance-program-82c394257199e74c235df7e9b2ab1ce9.

Fema.gov. “Flood Insurance,” July 2025. https://www.fema.gov/flood-insurance.

Fema.gov, 2025. https://my.nfipdirect.fema.gov/.

Sharif, Hatim. 2025. “Why Texas Hill Country, Where a Devastating Flood Killed More than 135 People, Is One of the Deadliest Places in the US for Flash Flooding.” The Conversation, July. https://doi.org/10.64628/AAI.76wjv3qus.

“Mandatory Purchase.” 2020. Fema.gov. March 5, 2020. https://www.fema.gov/about/glossary/mandatory-purchase.

“Community Status Book.” 2022. Fema.gov. March 17, 2022. https://www.fema.gov/flood-insurance/work-with-nfip/community-status-book.

“Participation in the NFIP.” 2024. Fema.gov. January 8, 2024. https://www.fema.gov/about/glossary/participation-nfip.

“National Flood Insurance Program (NFIP) Floodplain Management Requirements a Study Guide and Desk Reference for Local Officials.” 2005. https://www.fema.gov/sites/default/files/documents/fema-480_floodplain-management-study-guide_local-officials.pdf.

“What Is My Flood Risk?” 2016. Floodsmart.gov. 2016. https://www.floodsmart.gov/flood-zones-and-maps/what-is-my-flood-risk.

Federal Deposit Insurance Corporation (FDIC). Private Flood Insurance. Washington, DC: FDIC. Accessed August 26, 2025. https://www.fdic.gov/regulations/resources/director/financial-institutions/private-flood-insurance.html

Federal Emergency Management Agency (FEMA). Flood Insurance: What Is Covered. Washington, DC: U.S. Department of Homeland Security. Accessed August 26, 2025. https://www.fema.gov/flood-insurance/what-is-covered

Federal Emergency Management Agency (FEMA). Flood Insurance. Washington, DC: U.S. Department of Homeland Security. Accessed August 26, 2025. https://www.fema.gov/flood-insurance

Federal Emergency Management Agency (FEMA). Flood Insurance for Renters. FloodSmart.gov. Accessed August 26, 2025. https://www.floodsmart.gov/renters

Federal Emergency Management Agency (FEMA). Flood Insurance for Businesses. FloodSmart.gov. Accessed August 26, 2025. https://www.floodsmart.gov/businesses

Federal Emergency Management Agency (FEMA). Mandatory Purchase of Flood Insurance Guidelines. Washington, DC: U.S. Department of Homeland Security. Accessed August 26, 2025. https://www.fema.gov/flood-insurance/mandatory-purchase-flood-insurance-guidelines

Federal Emergency Management Agency (FEMA). Risk Rating 2.0: Equity in Action. Washington, DC: U.S. Department of Homeland Security. Accessed August 26, 2025. https://www.fema.gov/flood-insurance/risk-rating

Federal Emergency Management Agency (FEMA). Community Participation in the NFIP. Washington, DC: U.S. Department of Homeland Security. Accessed August 26, 2025. https://www.fema.gov/flood-insurance/protect/participate

Federal Emergency Management Agency (FEMA). Waiting Period for Flood Insurance. Washington, DC: U.S. Department of Homeland Security. Accessed August 26, 2025. https://www.fema.gov/flood-insurance/faq/waiting-period

Insurance Information Institute. Spotlight on Flood Insurance. New York, NY: Insurance Information Institute. Accessed August 26, 2025. https://www.iii.org/article/spotlight-on-flood-insurance

United States Congressional Research Service (CRS). Private Flood Insurance and the National Flood Insurance Program. Washington, DC: CRS Reports. Accessed August 26, 2025. https://crsreports.congress.gov/product/pdf/R/R45242

Spaulding, Malcolm L., Annette Grilli, Chris Damon, Reza Hashemi, Soroush Kouhi, and Grover Fugate. 2020. “Stormtools Design Elevation (SDE) Maps: Including Impact of Sea Level Rise.” Journal of Marine Science and Engineering 8 (4): 292. https://doi.org/10.3390/jmse8040292.

“Flood Maps.” 2024. Fema.gov. January 22, 2024. https://www.fema.gov/flood-maps.

Federal Emergency Management Agency (FEMA). Risk Rating 2.0: Equity in Action. Washington, DC: U.S. Department of Homeland Security. Accessed August 26, 2025. https://www.fema.gov/flood-insurance/risk-rating

Flood Insurance Guru. Flood Insurance Costs Guide. Carrollton, GA: The Flood Insurance Guru. Accessed August 26, 2025. https://www.floodinsuranceguru.com/flood-insurance-costs-guide

Insurify. Flood Zone X Insurance Cost & Coverage Guide. Cambridge, MA: Insurify, Inc. Accessed August 26, 2025. https://insurify.com/homeowners-insurance/knowledge/flood-zone-x

LendingTree. How Much Does Flood Insurance Cost? Charlotte, NC: LendingTree, LLC. Accessed August 26, 2025. https://www.lendingtree.com/home-insurance/flood-insurance-cost

SmartFinancial. Flood Zone X Insurance Costs. Costa Mesa, CA: SmartFinancial, Inc. Accessed August 26, 2025. https://smartfinancial.com/flood-zone-x-insurance-costs

For press requests or interview opportunities, reach out to our media team

media.na@ecoflow.com