Can I Claim the Solar Tax Credit in 2026?

- What Is the Solar Tax Credit?

- Who Is Qualified for the Solar Tax Credit?

- What Is Qualified Clean Energy Property?

- What Expenses Can Be Covered by the Solar Tax Credit?

- Will Subsidies, Rebates, and Incentives Affect the Solar Tax Credit?

- How to Claim the Solar Tax Credit

- New Changes in Effect After 2025

- It’s Time to Get Qualified With Solar

More people are trying to cut their electricity bills. Some want to help the planet. Others just want backup power when the grid fails. But solar energy still costs money upfront. That’s where the solar tax credit comes in. It gives you money back when you add solar power to your home. But, 2026 is your last year to apply for the solar tax credit.

What Is the Solar Tax Credit?

The solar tax credit is a benefit from the U.S. government. It helps people who add clean energy systems to their homes. When you install solar panels, battery storage, or other clean energy tools, you may get a 30% tax credit. A tax credit lowers the amount of tax you owe.

For example, if you spend $10,000 and get a 30% credit, you can subtract $3,000 from your tax bill. That’s not a refund check. But it means you pay less tax at the end of the year.

Who Is Qualified for the Solar Tax Credit?

Not everyone can claim the solar tax credit. To be eligible, you must meet some basic rules:

You must buy the system. That means you paid in cash or took a loan. If you lease the system or sign a power purchase agreement (PPA), you are not the owner. In that case, the credit goes to the company that owns the system.

Only new systems qualify. Used or rebuilt parts do not count. If you install a brand-new system on your home, it can qualify.

Your system must be placed on a home located within the United States. The home can be:

Your main house

A second home

A vacation property

However, rental homes are not always eligible unless you live in the home part-time. Talk to a tax advisor for special cases.

You need to owe federal income tax. The credit works by reducing your tax bill. If you do not owe any tax, you cannot use the credit right now. But you can carry it forward to future years.

What Is Qualified Clean Energy Property?

The solar tax credit only works for qualified clean energy systems. That includes:

Solar panels for electricity

Solar water heaters (but only if certified for home use)

Wind turbines

Fuel cell systems

Geothermal heat pumps

Battery storage system (at least 3 kilowatt hours)

What Expenses Can Be Covered by the Solar Tax Credit?

The credit covers more than just the panels or main system parts. It also covers many other costs that are part of the full project. These include:

Labor costs (installation, assembly, and wiring)

Permit fees

Inspection costs

Sales tax

Tools or hardware needed to connect the system

Wiring and inverters

Energy storage equipment (like batteries)

Even if you do the work yourself, you may count the money spent on materials. However, your own time or labor is not counted. Only paid work or materials can be used in the credit calculation.

Will Subsidies, Rebates, and Incentives Affect the Solar Tax Credit?

Yes, other benefits may change how much you can claim.

Utility Rebates

If your power company gives you money back, you cannot count that part in your credit. For example, if your system costs $10,000 but the power company gives you $2,000, your credit is based on $8,000.

State Tax Credits

These usually do not affect your federal solar tax credit. If your state gives you a tax credit, you can still claim the full 30% at the federal level.

Performance-Based Incentives (PBIs)

Some programs give you money over time based on how much energy your system makes. These do not reduce your credit. Only upfront cash payments reduce your eligible amount.

It’s smart to look at both federal and state programs. You might be able to stack several types of help together.

How to Claim the Solar Tax Credit

It’s not hard to get the credit, but you must do the steps correctly. Here is a simple guide.

Step 1: Check If You and Your Home Qualify

Check three things:

The home is in the United States

You own the clean energy system

The system is new and on the approved list (solar panels, solar heaters, battery storage, etc.)

If your system meets these points, you can move to the next step.

Step 2: Buy and Set Up the System

Pick your clean energy system. Pay for it, have it installed, and connect it to your home. The system must be fully working before you can claim the credit.

You can use your own money or a loan, but the system must be in your name.

Step 3: Keep Your Records

You do not need to send receipts when you file your tax return. But keep them safe. You may need them if your taxes are checked later.

Hold onto the following:

Purchase receipts

Installation bills

Equipment model and type

Any papers that show the system meets rules (like certificates or warranties)

These papers also help when you sell your home later.

Step 4: Use IRS Form 5695

When you file your tax return, fill out Form 5695. This is the form for Residential Energy Credits.

You can download it from the IRS website or use tax software. Fill in your total clean energy costs and calculate your credit. Then copy the final number to the “Credits” section of your main tax form (Form 1040).

If the credit is bigger than your tax bill, you can use the extra next year.

New Changes in Effect After 2025

The H.R.1 - One Big Beautiful Bill Act was passed by the U.S. House of Representatives on May 22, 2025, passed by the Senate on July 1, 2025 and signed into law by President Trump on July 4, 2025. This law ends the 30% residential solar tax credit after December 31, 2025. Systems installed and inspected in 2025 will still qualify for the credit. However, starting January 1, 2026, the residential tax credit will no longer apply to new solar installations.

What Those Changes Mean for You

2025 is the final year to claim the full 30% residential clean energy credit.

Systems installed in 2025 still qualify—but you must act quickly.

It’s Time to Get Qualified With Solar

If you want to lock in the full 30% federal solar tax credit, 2025 may be your last chance. Waiting too long could mean losing thousands of dollars in savings. To qualify, your system must be installed and inspected before the end of the year. Delays in shipping or permits could push your timeline past the deadline, so now is the time to act.

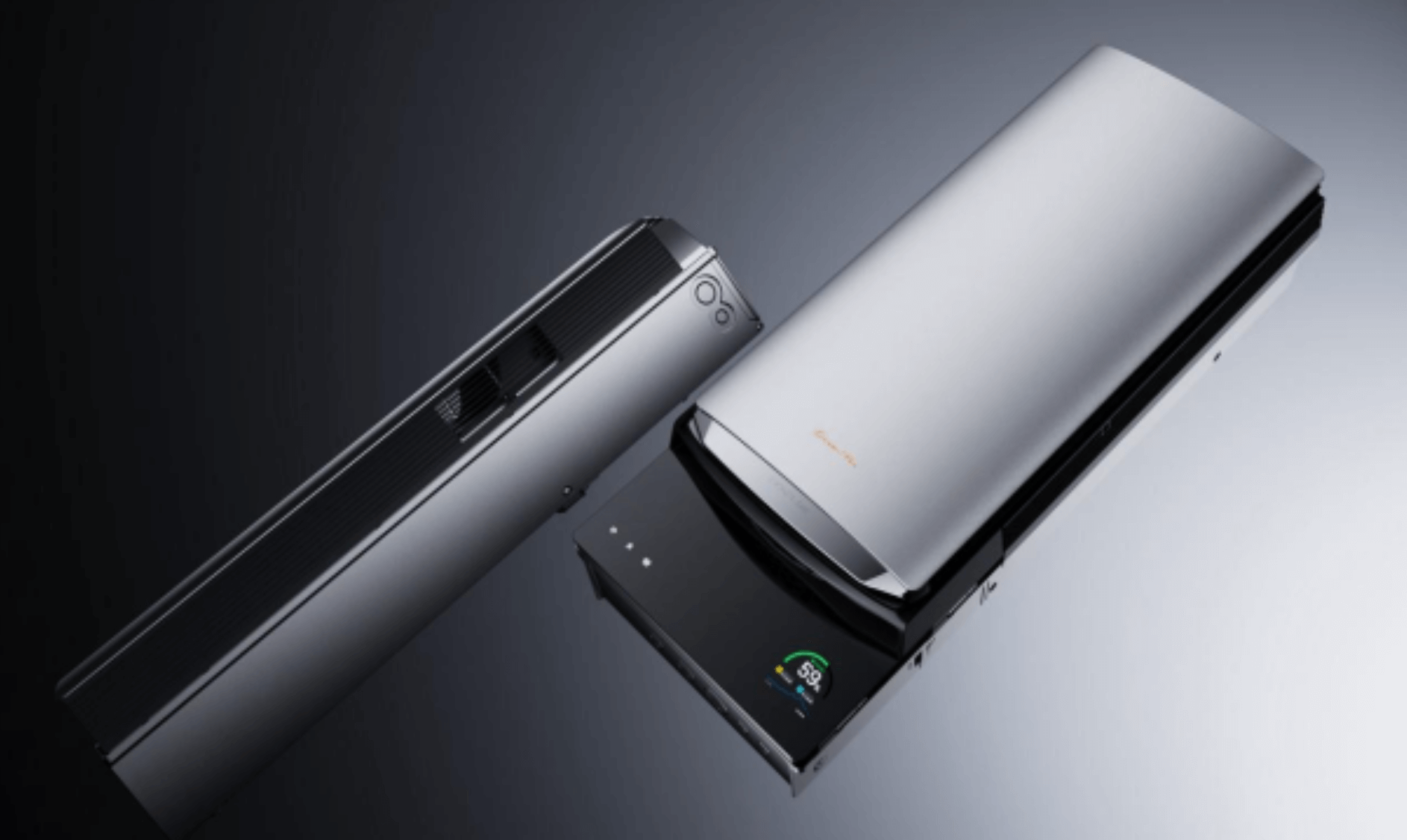

For families with higher energy use, it makes sense to choose a complete solution that offers long-term value. The EcoFlow OCEAN Pro is a powerful, expandable solar battery system designed for full-house support. With up to 80kWh of storage, 24kW output, and smart AI energy tools, it gives you both energy independence and strong return on investment.

The OCEAN Pro also uses LFP battery cells and meets high safety and performance standards—ideal for homes that want reliable backup during heatwaves, wildfires, or grid failures. And because it’s modular, you can install the system you need now, and expand later if needed.

If you wait, you may miss the credit. If you act now, you could secure a cleaner, quieter, and more cost-efficient future—for your home and your wallet. EcoFlow OCEAN Pro is ready when you are, click here to find certified local installers near you!

For press requests or interview opportunities, reach out to our media team

media.na@ecoflow.com