Hurricane Insurance: Is Your Home Covered?

Hurricanes and tropical storms cause billions of dollars of damage annually in the US.

In 2024 alone, hurricanes caused an estimated $500 billion[1] in total damages and economic loss.

Hurricane season in 2024 was “one of the deadliest in modern U.S. history as four storms killed more than 300 people from the Gulf Coast to the Appalachians.”[2]

With extreme weather events and natural disasters like tropical cyclones, wildfires, and floods increasing in frequency and severity, ensuring that your home is adequately insured has never been more urgent.

Is your home covered?

The answer may not be as simple as you think.

Understanding Hurricane Insurance Coverage

“Hurricane insurance” doesn’t exist, but hurricane deductibles DO in many parts of the US.

Covering your home for the damage that hurricanes often inflict typically requires a basket of policies, such as windstorm and flood insurance, in addition to your standard homeowners policy.

What Homeowners Insurance Typically Covers

Homeowners insurance policies vary significantly by carrier and location, but typically cover only wind-related damage from hurricanes.

Ironically, even that isn’t covered by many homeowners policies in states at the biggest risk from windstorms and flooding.

Standard homeowners policies typically cover a portion of expenses from damages caused by windstorms and hurricanes:

Wind and hail damage to the exterior of the property, such as roofs, siding, and windows.

Removal of debris from a property, such as fallen trees and branches.

SOME water damage, but not from flooding. Water damage covered by homeowners insurance must occur directly as the result of wind. For example, water entering your home through a roof damaged by wind.

Additional living expenses (ALE) if you’re forced to leave the property or it becomes uninhabitable.

Personal property damage to items like furniture, electronics, clothing, etc.

Common Exclusions in Homeowners Policies

Floods: Often the most devastating consequences of tropical storms and hurricanes.

Backed-up sewage systems, which typically occurs during heavy rainfall.

Wind damage in high-risk locations.

Hurricane Deductibles

In many states at high risk of storm damage, homeowners and businesses are also subject to hurricane deductibles.

According to Investopedia, hurricane deductibles apply in the following states.

Alabama

Connecticut

Delaware

Florida

Georgia

Hawaii

Louisiana

Maine

Maryland

Massachusetts

Mississippi

New Jersey

New York

North Carolina

Pennsylvania

Rhode Island

South Carolina

Texas

Virginia

Washington D.C.

Hurricane deductibles began to be included in homeowners policies after Hurricane Andrew hit in 1992 and became more prevalent after Hurricane Katrina in 2005.

Deductibles for hurricane damage vary by carrier and location, but generally, homeowners are subject to a reduction in the amount of money they can claim for damages caused by named hurricanes and severe tropical storms.

How Are Hurricane Deductibles Calculated?

Some states mandate the type of hurricane deductible that insurance companies can include or must offer as an option in homeowners policies.

For example, Florida requires carriers to provide a flat-rate hurricane deductible of $500 to homeowners and options of 2%, 5%, and 10% of the residence’s insured value.

Choosing a $500 maximum deductible typically means paying a significantly higher monthly premium rate.

However, it’s essential to understand that a higher monthly premium may be more than worth the investment if your home undergoes significant damage in a hurricane.

For example, if your home is insured for $400,000 and your policy has a 10% deductible, your insurance company could deduct $40,000 from the maximum value of your claim, a difference of $39,500 less than if your deductible were $500.

(Source: FloodSmart)

Flood Insurance: An Essential Protection

Rising sea levels from storm surge in coastal areas and inland flooding from heavy rainfall are the most devastating consequences of tropical storms and hurricanes.

Heavy winds can wreak havoc, but flooding is usually far more damaging to human life and property.

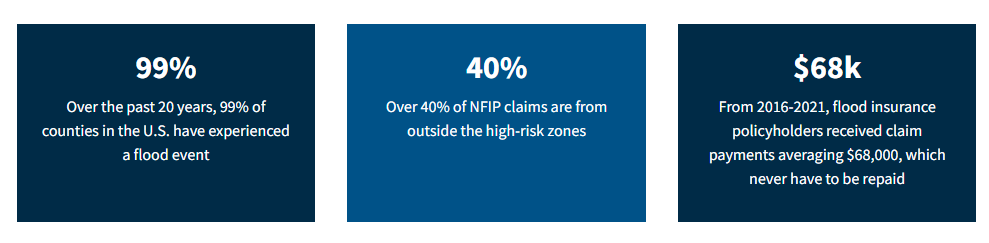

According to FEMA, “Over the past 20 years, 99% of counties in the US have experienced a flood event.”

Recent floods in the Texas Hill Country had already claimed over 130 lives by July 13th, 2025, with damages estimated at over $20 billion.

Standard homeowners insurance does not cover flood damage.

The federal government created the National Flood Insurance Program (NFIP) in 1968 after private insurance providers refused to cover flood damage in many high-risk areas, particularly in Texas and Florida.

The NFIP, administered by the Federal Emergency Management Agency (FEMA), enables property owners in many parts of the United States to purchase flood insurance coverage for their businesses or homes.

In Special Flood Hazard Areas (SFHA) — floodplain areas at high risk for flooding — carrying flood insurance may be mandatory for mortgage eligibility for purchasing a property or receiving disaster assistance when flooding occurs.

Even if flood insurance isn’t required where you live, it’s essential to keep in mind that over 40% of NFIP insurance claims come from outside designated high-risk areas.

Find out if your community participates in the NFIP here.

Preparing Your Home for Hurricane Season

Whether you live in a coastal area that experiences tropical storms regularly or in an area where extreme weather is rare, you can take some simple steps to ensure disaster preparedness.

Inspect and repair your roof, doors, and windows.

Keep trees and shrubs trimmed to reduce the risk of damage from broken branches, etc.

Secure outdoor furniture

Install storm shutters or invest in pre-cut plywood to quickly cover windows.

Keep fully stocked emergency preparedness kits with non-perishable food, water, medications, flashlights, first aid kits, etc.

Create a Home Inventory for Insurance Purposes

Once you’ve confirmed that you have adequate homeowners, flood, and windstorm insurance for your property, keeping a detailed inventory of your belongings significantly expedites the claim process.

NFIP publishes a helpful flood insurance policy checklist to help ensure you’ve covered all your bases.

Utilizing EcoFlow Portable Power Stations

Widespread blackouts and extended power outages are almost a given during hurricanes, floods, and other extreme weather events.

EcoFlow portable power stations provide essential home backup to help ensure you’re prepared for emergencies.

Final Thoughts

In a time when research shows that hurricanes may be increasing in frequency and regularity, you can’t afford not to insure your home adequately.

Being prepared for extreme weather events and natural disasters requires planning for emergencies.

EcoFlow whole-home battery backup systems help ensure you’re never without power during extended outages, no matter what the cause.

Check out our selection today.

Sources

“AccuWeather Report: $500 Billion in Damage and Economic Loss Estimated after Destructive and Unprecedented Hurricane Season.” 2025. Accuweather.com. 2025. https://www.accuweather.com/en/press/accuweather-report-500-billion-in-damage-and-economic-loss-estimated-after-destructive-and-unprecedented-hurricane-season/1717667.

Cusick, Daniel. 2024. “Helene, Milton Marked One of the Deadliest Recent Hurricane Seasons.” E&E News by POLITICO. December 2, 2024. https://www.eenews.net/articles/helene-milton-marked-one-of-the-deadliest-recent-hurricane-seasons/.

Segal, Troy. 2024. “Hurricane Insurance Isn’t Real. Instead, You Need This Coverage for Storm Damage.” Investopedia. 2024. https://www.investopedia.com/what-is-hurricane-insurance-definition-coverage-and-costs-8737534.

“MSN.” 2025. Msn.com. 2025. https://www.msn.com/en-us/news/us/texas-flooding-live-updates-over-130-killed-as-flash-flood-threat-increases-in-texas/ar-AA1HZROu.

“What Is My Flood Risk?” 2016. Floodsmart.gov. 2016. https://www.floodsmart.gov/flood-zones-and-maps/what-is-my-flood-risk.

“OFFICE of the GENERAL COUNSEL AUGUST, 1997 I.” n.d. https://www.fema.gov/sites/default/files/2020-07/national-flood-insurance-act-1968.pdf.

“Who’s Eligible for NFIP Flood Insurance?” 2025. Floodsmart.gov. 2025. https://www.floodsmart.gov/get-insured/eligibility.

“How to Prepare for a Flood — and Lower Your Premium.” 2025. Floodsmart.gov. 2025. https://www.floodsmart.gov/get-insured/buy-a-policy/homeowner-checklist

For press requests or interview opportunities, reach out to our media team

media.na@ecoflow.com