Homeowners Rush to Install Solar for Clean Energy Tax Credit

Since 2023, homeowners have enjoyed the most generous federal government incentives for switching to solar and other sources of clean, renewable energy ever in US history.

Unfortunately, the opportunity to save 30% on eligible solar panel and home battery backup systems is coming to an end much sooner than expected.

Eligible homeowners across the country are rushing to install eligible residential photovoltaic and solar battery systems before it’s too late.

Fortunately, you’ve still got time to save…

But not for long.

Understand the Impact of the One Big Beautiful Bill

The One Big Beautiful Bill Act (OBB) was signed into law on July 4th, 2025, and is the signature legislative achievement of President Donald J. Trump’s second term to date.

Benefits include new tax deductions for tips, overtime pay, and interest on car loans.

A key provision creates "Trump Accounts," which are tax-deferred savings accounts for children.

The OBB also permanently increases the child tax credit by $200.

Despite bipartisan protests in Congress and the Senate, the One Big Beautiful Bill also eliminates tax breaks for utility-scale and residential clean energy systems like solar panels, home batteries, and wind turbines.

The $7,000 tax credit for electric vehicles (EVs) ends in September 2025.

The Residential Clean Energy Credit for homeowners now ends on December 31st, 2025, after originally being scheduled to run until 2032.

Explore Federal Tax Credits for Home Solar Panel Systems

The Residential Clean Energy Credit — also known as the Federal Solar Tax Credit — is the most generous federal government incentive for solar panels and home battery systems in US history.

The One Big Beautiful Bill ends eligibility for the 30% federal income tax credit as of January 1st, 2026, but fortunately, it’s not too late to take advantage and save thousands of dollars on installing a home solar panel system this year.

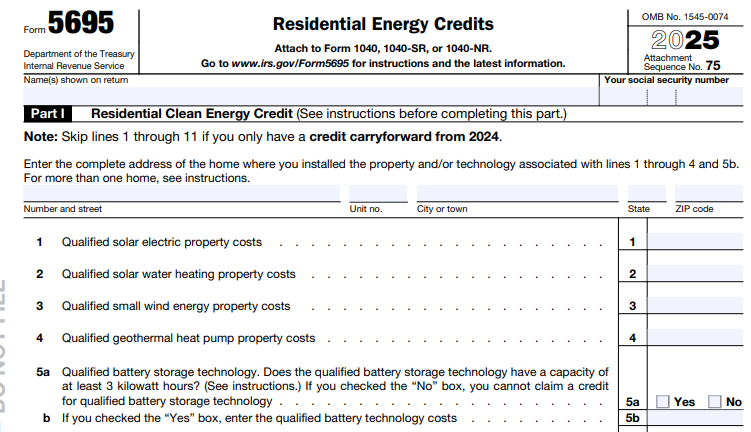

To qualify for the Residential Clean Energy Credit, the following conditions must be met.

You must be a US taxpayer (citizen or resident alien).

The solar panel and/or home battery system must be installed and operational before midnight on December 31st, 2025.

The system must be new.

It must be installed at your primary or secondary residence. Landlords who do not live on the premises are not eligible for the credit, and neither are renters.

You must purchase or finance the system — leased or rented systems are not eligible.

Home battery systems must have a storage capacity of 3kWh or higher.

You must file IRS Form 5695 with your personal income tax return to claim the Residential Clean Energy Credit.

Taking advantage of the 30% IRS 25(D) tax credit before it expires this year can save you thousands of dollars on the purchase and installation cost of an eligible solar power and/or home battery system.

There’s no cap on how much money you can deduct from your personal income tax liability, and any credit balance can be carried over to subsequent tax years.

You can even qualify if you don’t owe any personal income tax in 2025 but expect to owe some in 2026 and following tax years.

It’s essential to note, however, that the tax credit is nonrefundable, meaning it can only be applied against your tax liability in the year of installation or subsequent tax years until the credit is applied in full to taxes you owe.

You will not receive an income tax refund if the credit exceeds your personal tax liability.

How Much Can You Save With the Solar Tax Credit

Since there’s no dollar cap on how much you can deduct, you can save 30% of the total purchase and installation costs of eligible clean energy property, including:

Solar electric panels (photovoltaic, not solar thermal)

Battery storage technology (capacity of at least 3 kilowatt hours)

Solar water heaters (certified by the Solar Rating Certification Corporation or a comparable entity endorsed by your state)

Wind turbines

Geothermal heat pumps (meet Energy Star requirements in effect at the time of purchase)

Fuel cells

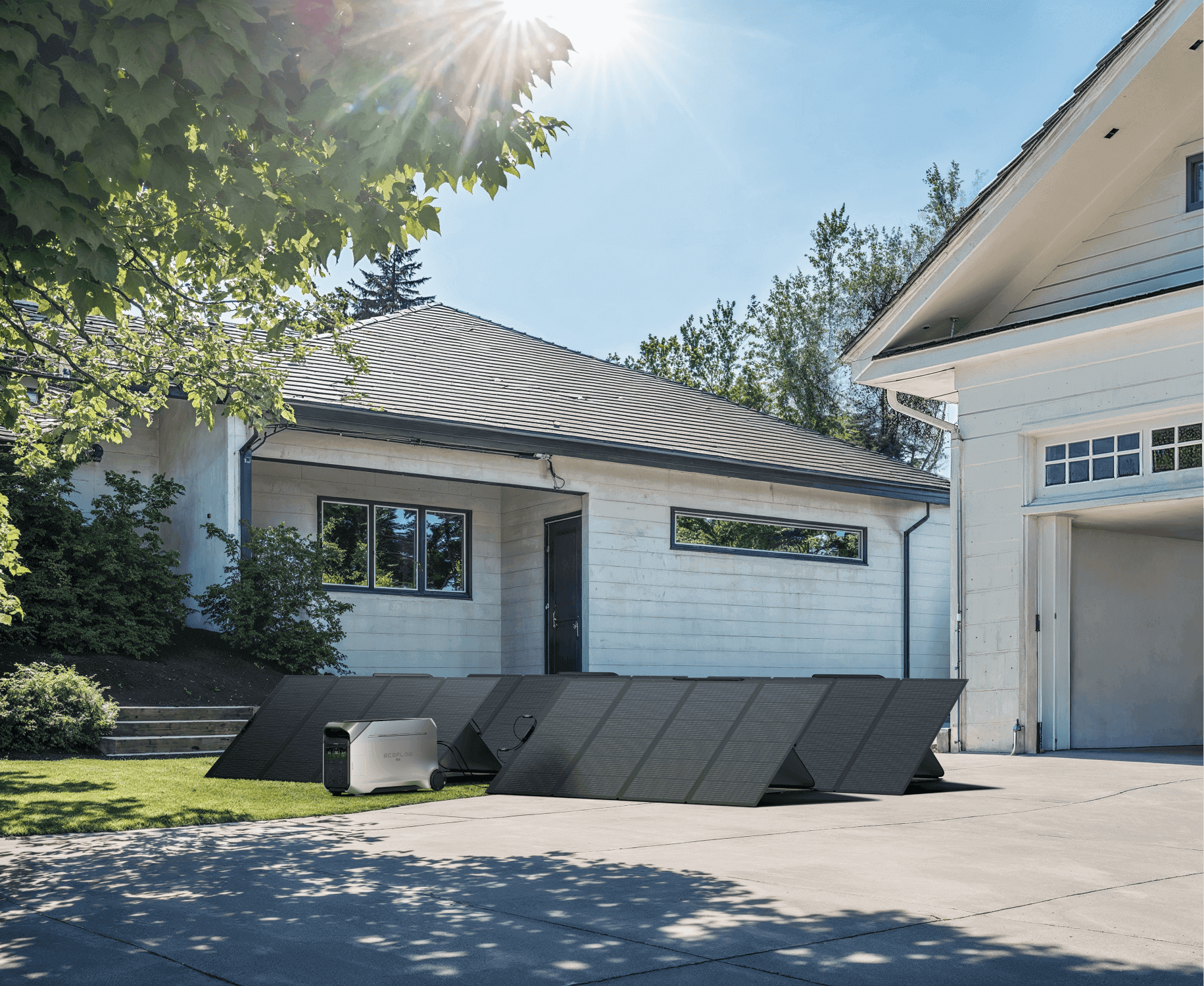

For example, EcoFlow DELTA Pro Ultra is a whole-home solar generator and battery storage system that’s eligible for the Residential Clean Energy Credit as long as it is purchased and installed by the end of 2025.

Let’s assume you have a medium-sized home that consumes around 10 kilowatts of power or less for most of the day, but sometimes peaks at 14kW at certain times of day.

DELTA Pro Ultra is highly expandable with up to 21.6kW of AC Output and 90kWh of LFP battery storage capacity if you chain 3 x DELTA Pro Ultra Inverters in parallel.

For this example, let’s look at the tax savings on a 2 x inverter with 30kWh of battery storage capacity, just over what the average US household consumes in a day.

Product | Retail Price* | Number of Units | Total Purchase Cost | 30% Tax Credit Savings |

EcoFlow DELTA Pro Ultra Inverter | $2,799 | 2 | $5598.00 | $1679 |

EcoFlow DELTA Pro Ultra LFP Home Battery | $2,324 | 5 | $11,620 | $3,486 |

EcoFlow 400W Rigid Solar Panel | $818 | 12 | $9,817 | $2,945 |

Installation Costs | $1,500 | N/A | $1,500 | $450 |

Gross Totals | $28,535 | $8,560 | ||

Net Purchase Cost After Credit | $19,975 | |||

As you can see, the savings from the Residential Clean Energy Credit are substantial, $8,560 against your income tax liability in the configuration above.

It’s no wonder that homeowners across the US are racing to take advantage of the 30% tax credit before it goes away at the end of 2025.

Taking advantage of all the available federal, state, local, and utility company incentives is one of the best ways to reduce your upfront costs, shorten your solar payback period, and maximize your return on investment.

Identify Opportunities in Solar Financing

The price of solar panels and home battery systems has dropped significantly in recent years as demand has risen and technology has improved dramatically.

However, the upfront costs of investing in residential solar panel systems remain a significant barrier to entry for many Americans.

Fortunately, the Residential Clean Energy Credit is available to homeowners who pay for home solar power systems over time through direct-from-manufacturer financing options.

Many reputable solar panel and home battery systems offer low-interest financing options to qualified customers.

As long as the system is installed and operational by midnight on December 31st, 2025 (the date of service), you should be able to write off the final purchase and installation costs of an eligible system, regardless of how much you paid upfront.

As always, consult with your accountant or other tax professional before finalizing your purchase if you’re counting on receiving the 30% solar tax credit.

Maximize Your Savings with EcoFlow's Solar Generators

EcoFlow makes a wide range of solar generators and home backup battery systems that qualify for the Residential Clean Energy Credit.

EcoFlow DELTA Pro 3 is an ideal, low-cost, expandable solar solution for essential home backup.

Whether you need portable power for hiking or the ability to live entirely off-grid, EcoFlow has a solution for you.

Check out our selection today.

* Disclaimer: Before reading this guidance, please remember that tax matters can be highly individualized and complex. EcoFlow does not provide any assurances or guarantees concerning potential tax credits associated with our products. Any information in this guidance is solely for educational purposes and shall not be construed as legal advice. We recommend you rely on the expertise of tax professionals for accurate and personalized tax advice.

** Based on US direct-from-manufacturer retail prices as of August 5, 2025. All prices are subject to change.

Resources Cited

Arrington, Rep. 2025. “H.R.1 - 119th Congress (2025-2026): One Big Beautiful Bill Act.” Congress.gov. 2025. https://www.congress.gov/bill/119th-congress/house-bill/1.

Eckert, Nora, and Abhirup Roy. 2025. “Automakers Push EV Sales as $7,500 US Tax Credit Is Set to End.” Reuters. July 9, 2025. https://www.reuters.com/business/autos-transportation/automakers-push-ev-sales-7500-us-tax-credit-is-set-end-2025-07-09/.

“Residential Clean Energy Credit | Internal Revenue Service.” 2023. Irs.gov. 2023. https://www.irs.gov/credits-deductions/residential-clean-energy-credit.

“Caution: DRAFT-NOT for FILING.” n.d. Accessed August 4, 2025. https://www.irs.gov/pub/irs-dft/f5695--dft.pdf.

“Frequently Asked Questions about Energy Efficient Home Improvements and Residential Clean Energy Property Credits | Internal Revenue Service.” 2022. Irs.gov. 2022. https://www.irs.gov/credits-deductions/frequently-asked-questions-about-energy-efficient-home-improvements-and-residential-clean-energy-property-credits.

For press requests or interview opportunities, reach out to our media team

media.na@ecoflow.com