What is the Toronto Solar Rebate and Home Energy Loan and How Much Can I Get?

Federal and provincial solar and energy efficiency rebates and tax incentives have been part of the government policy landscape in Canada for almost 20 years.

Launched in 2007, the ecoENERGY Retrofit Program — was the first federal program designed to encourage homeowners to make energy-efficient home improvements — including the purchase of solar thermal water heaters and photovoltaic (solar power) systems.

Today, depending on where you live, solar rebates and tax credits are available from all levels of government (including municipal) and utility providers.

If you’re a homeowner residing in the City of Toronto, you’re likely not only eligible for programs like the Canada Greener Home Initiative (Federal) and Home Renovation Savings Program (Provincial) — you can get even more HELP*.

What Are Toronto’s Rooftop Solar Rebates and Home Energy Loans?

The City of Toronto’s Home Energy Loan Program (HELP) offers low-interest loans to owners of detached, semi-detached, or row houses and can be combined with additional incentives and rebates to green your home.

If eligible, you can qualify for a loan of up to $125,000 to improve your home's energy efficiency — including the purchase and installation of rooftop solar panels and whole-home backup battery systems.

Toronto Home Energy Loan Program (HELP) Rates and Terms*

Terms | Fixed Interest Rate |

5 years | 3.14% |

10 years | 3.90% |

15 years | 4.35% |

20 years | 4.54% |

*Valid until June/30/2025

Under the current HELP terms, an eligible whole-home solar generator with rooftop solar panels that costs $10,000 to purchase and install could be paid off at $91/month over 10 years or $61/month over 15 years.

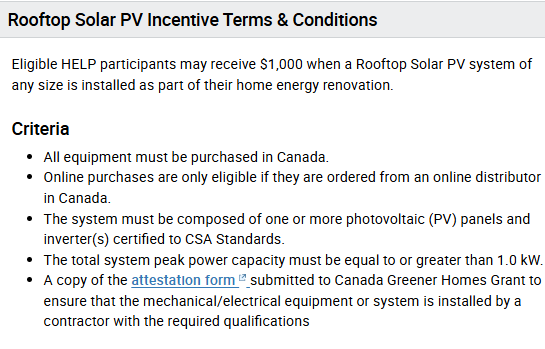

Additionally, eligible HELP participants can receive the $1,000 Rooftop Solar PV Incentive when installing a solar panel system with a minimum peak power capacity of one kilowatt (1kW) or more.

The system must be purchased in Canada or online from a Canadian distributor to be eligible for the Toronto Solar Rebate.

For example, EcoFlow’s mountable solar panel + battery storage systems like DELTA Pro Ultra are warehoused and shipped in Canada and should be eligible for the credit as long you also install rooftop solar panels with a combined rated power output of 1kW or more.

In addition to HELP and the Eco-Roof Incentive Program (highlighted in green below), numerous other energy efficiency incentives are available to residential property owners, particularly those who use natural gas to heat their homes.

City of Toronto: Incentives & Rebates to Green Your Home

Improvement | Incentive | Requirements | Provider |

Air Sealing* | Up to $150 | Must be an Enbridge customer and complete a pre- and post-Home Energy Audit. Receive $100 for reaching a base target on the energy audit report or $150 for reaching 10% above target. | |

Boiler or Combi System | $100 | Must be an Enbridge customer and complete a pre- and post-Home Energy Audit. Receive $750 for replacing your less than 89% AFUE natural gas, propane, or oil boiler with a 90% or higher AFUE condensing system. | Home Efficiency Rebate |

Furnace | $250 | Receive $750 for replacing or purchasing a high-efficiency furnace with a higher AFUE natural gas, or propane furnace. Receive an additional $250 for installing a high-efficiency furnace equipped with an electronically commutated motor (ECM). Must be an Enbridge customer. | Home Efficiency Rebate |

Green / Cool Roof | Varies | Grants are available to support the installation of green roofs and cool roofs on residential homes. A green or cool roof can reduce your home's energy use, retain stormwater, and more. You can receive: $2 to $5/m2 for a cool roof. $100/m2 for a green roof | Eco-Roof Incentive Program / City of Toronto |

Home Assistance Program | 100% of cost | If eligible, you can receive the following free of charge: ENERGY STAR® light bulbs (LED), power bars with timers, efficiency shower-heads (standard and handheld), or aerators (kitchen and bathroom). | |

Home Energy Audit | $550 | Receive $550 to cover the cost (minus HST) of both a pre- and post-Home Energy Audit when you complete at least two of the eligible home energy upgrades under Enbridge's Home Energy Conservation program. | Home Efficiency Rebate |

Home Energy Loan Program | Up to $75,000 | Get a low-interest loan from the City of Toronto to cover the cost of your home energy improvements. Rates start as low as 2%. Repay the loan at any time, without penalty. Eligible improvements include energy-efficient furnaces, windows, doors, solar PV panels, insulation and more. You may use this program in conjunction with other rebate and incentive offerings. | Home Energy Loan Program / City of Toronto |

Insulation (for natural gas customers) | 100% of cost | If you qualify, you could receive new insulation and draft proofing installed by experienced professionals at no cost. Your home must be heated by natural gas and the homeowner must fall into one of the eligible household income brackets in order to qualify. Visit www.winterproofing.ca to learn more about eligibility requirements and complete an online application form. | |

Insulation - Basement | Up to $1,250 | • $500: Insulate crawl space wall to meet a value of at least R-12. • $750: Insulate basement to meet a value of at least R-12. • $1,000: Insulate crawl space wall to meet a value of at least R-23. • $1,000: Insulate floor above crawl space to meet a value of at least R-32. • $1,250: Insulate basement to meet a value of at least R-23. Rebates are pro-rated. | Home Efficiency Rebate |

Insulation - Exterior Walls | Up to $3,000 | • $1,000: Add at least R-3.8 to meet a value of at least R-12. • $1,750: Add at least R-9 to meet a value of at least R-12. • $3,000: Insulate to meet a value of at least R-20. Rebates are pro-rated based on the percentage of total wall area upgraded—a minimum of 20 percent must be upgraded. Homes with less than 2×4 structure are exempt from R12 minimum with photo documentation of wall structure. Rebates are pro-rated. | Home Efficiency Rebate |

Insulation - Attic / Cathedral / Flat roof | Up to $650 | • Up to $650: Increase attic insulation from R-35 or less to at least R-60. • Up to $650: Increase insulation to a cathedral/flat roof by at least R-14.Rebates are pro-rated based on the percentage of total ceiling area upgraded—a minimum of 20 percent must be upgraded. If both attic and cathedral/flat roof are upgraded, rebates will remain capped at $650. | Home Efficiency Rebate |

Smart Thermostat | $75 | Purchase a qualifying Smart Thermostat and install it yourself or through a qualifying contractor before December 31, 2018. | Home Efficiency Rebate |

Water Heater | $400 | Conduct a pre- and post- Home Energy Audit with a Registered Energy Advisor (REA) before and after the installation of your energy improvements and receive $200 for replacing your water heater with 0.80 EF or higher tanked natural gas or propane water heater or a 0.82 EF or higher tankless natural gas or propane water heater. Combi-system qualifies as a water heater. | Home Efficiency Rebate |

Windows / Door/ Skylight | $40/ window, door, skylight | Conduct a pre- and post- Home Energy Audit with a Registered Energy Advisor (REA) before and after the installation of your energy improvements and receive $40 per rough opening (windows, doors, or skylights). | Home Efficiency Rebate |

Who Is Eligible for the Toronto Solar Rebate & Home Energy Loan?

The Rooftop Solar Incentive is available to Home Energy Loan Program (HELP) participants who take out a low-interest loan to make eligible energy efficiency improvements.

Unfortunately, the Rooftop Solar Incentive is only available to HELP recipients — not renters or homeowners who don’t take out a loan.

Because the rebate only applies to rooftop photovoltaic (PV) systems, apartment condominium owners are also ineligible.

Toronto Home Energy Loan Program (HELP) Eligibility

According to the City of Toronto, you may qualify for a low-interest HELP loan if:

You own a detached, semi-detached, or row house in the City of Toronto (the property’s postal code must start with an “M”);

all of the property owners on title consent to participate in the program;

You do not have more than three instances of a property tax or utility account being 60 days past due in the last three years;

You obtain written consent from your mortgage lender if applicable. If your property is subject to a mortgage, HELP will send you a customized Lender Consent Form once you submit your application.

Toronto Solar Rebate Eligibility

Toronto’s Rooftop PV Incentive is only available to Home Energy Loan Program recipients.

To receive a HELP loan, homeowners must follow an application process, which includes submitting a funding request to the program administrators.

If your home energy improvements include the purchase and installation of a rooftop solar array, the details should be included in your funding request, which must include “details and cost estimates based on contractor quote(s).”

If you inform reputable contractors and solar installers that you wish to purchase a system eligible for the Rooftop PC Incentive as part of your HELP loan, they can help ensure you meet your goals.

As you can see, the eligibility requirements are pretty straightforward…

However, it’s essential to ensure that any system you consider meets the Terms and Conditions found here.

How Much Can You Get From the Toronto Solar Rebate?

If you successfully apply for the Home Energy Loan Program (HELP) and install a solar panel system with 1kW (or more) of maximum electricity generation potential, you may receive a $1000 Rooftop PV Incentive from the City of Toronto.

The Toronto Solar Rebate can be combined with federal and provincial energy efficiency incentives, such as the Ontario Home Renovation Savings Program, which rebates homeowners up to 30% of the cost of rooftop solar panels and battery storage systems.

A $1000 rebate is nothing to sneeze at, but it’s unlikely to make a significant dent in the costs of installing and purchasing an eligible solar power system at your home.

Even combined with provincial and federal incentives, it’s best to think of residential solar power as a mid-to-long-term investment that makes sense financially and for keeping your family safe during ever-increasing power outages and grid instability.

Fortunately, the City provides a free SolarTO map to help you estimate how much money you can save by generating electricity with a rooftop PV system at your location over time.

Once you achieve solar payback by recouping your costs through Hydro bill savings, the ongoing savings are yours to keep.

Money saved is money earned.

How to Apply

Here’s the step-by-step application process for the Home Energy Loan Program and Rooftop PV Incentive.

Complete the Online Application Form

If your online application is successful, the City will send a funding offer that indicates the maximum amount you can borrow through HELP to make energy-efficiency improvements to your home.

If you have a mortgage, additional paperwork is required and will be provided.

Home Energy Assessment

With a funding offer in hand, it’s time to book a professional energy assessment for your home.

You must book an appointment with an Energy Advisor authorized by Natural Resources Canada to proceed with the HELP process.

Incentives and rebates may be available to help cover the cost.

Once the in-person inspection of your home is complete, you will receive:

Renovation Upgrade Report with recommended improvements

EnerGuide rating of your home’s current energy performance

Details of available incentives

Make sure the Energy Advisor knows that you wish to install a rooftop solar panel system that meets the eligibility requirements for the $1000 rebate.

Submit the Funding Request

Now that you have a detailed report with recommended improvements to your home decide which ones you want to proceed with based on your budget and goals.

Your funding request must include details and costs (from contractor quotes) of the improvements you want to undertake with a HELP loan.

You should also include a list of estimated incentives and rebates available, including the Rooftop Solar Incentive, if applicable.

Your Energy Advisor should be able to help you compile your HELP funding request.

Property Owner Agreement (POA)

Once your funding request is approved, HELP will provide a Property Owner Agreement (POA) — essentially the loan agreement between you and the City of Toronto.

Sign and return the POA.

Once approved, you are eligible to receive up to 30% of the total loan amount to start improvements.

Project Completion and Reporting

The City is not involved in administering your HELP project—as the property owner, it’s your responsibility to hire and pay contractors and oversee their work.

Additionally, it’s your duty to obtain any permits required by the municipality or province — including permits for rooftop solar panel installations.

Most registered Energy Advisors will gladly provide you with contractor recommendations.

Many building firms will complete their work based on HELP funding approval — often accepting a 30% deposit and 70% upon completion.

It’s advisable to work with a contractor who has undertaken HELP improvements previously so that they’re familiar with the requirements.

Once work is complete, book a post-retrofit appointment with your Energy Advisor.

The Advisor will assess the work, sign a Completion Report and provide a new EnerGuide label for your home.

Submit Your Completion Report and Receive Your Funds

Once the City of Toronto approves your Completion Report, the remaining funds for your project will be released.

If you have already received 30% of your funding request to commence work, the additional 70% will be credited to your bank account.

Once you receive your funds, it is your responsibility to ensure that all contractors and suppliers are paid in full for any outstanding balances.

Pay Loan Installments on Your Property Tax Bill

HELP loans are funded directly by the City of Toronto — not a traditional lender like a bank.

You must repay the loan in 11 monthly installments each year — per your Property Owner Agreement — until it’s settled in full.

If you miss payments, you’re “subject to the same penalties, remedies and lien priorities” you would face from not paying your property tax bills.

You can repay the loan early without penalty but will be subject to a Revenue Service fee.

Your HELP representative will be able to advise you of the fee amount.

You can then determine if interest savings from early repayment make financial sense.

Frequently Asked Questions

How Long Does It Take To Receive the Toronto Solar Rebate?

Toronto’s Rooftop PV Incentive is only available to participants in the Home Energy Loan Program (HELP) who install solar power systems with at least 1kW of potential electricity output at their primary residence. HELP is only available to Toronto homeowners who live in their detached, semi-detached, or row house. If an eligible rooftop PV system is part of your HELP funding request, you may receive 30% upon approval and the remaining 70% once the work is complete.

Final Thoughts

Government incentives, like the City of Toronto’s HELP loan program and Rooftop Photovoltaic Incentive, help reduce the costs of installing residential solar power systems that can reduce or eliminate electricity bills and dependence on the utility grid.

While tax credits and rebates help make renewable energy more accessible and affordable, it’s the mid-to-long-term financial benefits of installing a residential solar power system that make it a viable investment.

Not to mention the immediate benefits a solar + storage system — like EcoFlow DELTA Pro Ultra — can bring, like peace of mind and home energy security during power outages.

EcoFlow makes a wide range of off-grid battery backup and solar panel solutions for everything from backpacking to running your entire house during a blackout.

Check out our selection today.

*Disclaimer: Before reading this guidance, please remember that tax matters can be highly individualized and complex. EcoFlow does not provide any assurances or guarantees concerning potential tax credits associated with our products. Any information in this guidance is solely for educational purposes and shall not be construed as legal advice. We recommend you rely on the expertise of tax professionals for accurate and personalized tax advice.