What is the Clean Technology Investment Tax Credit, and Am I Eligible?

Eliminating greenhouse gas emissions is a high priority for Canadian governments at all levels: federal, provincial, and municipal.

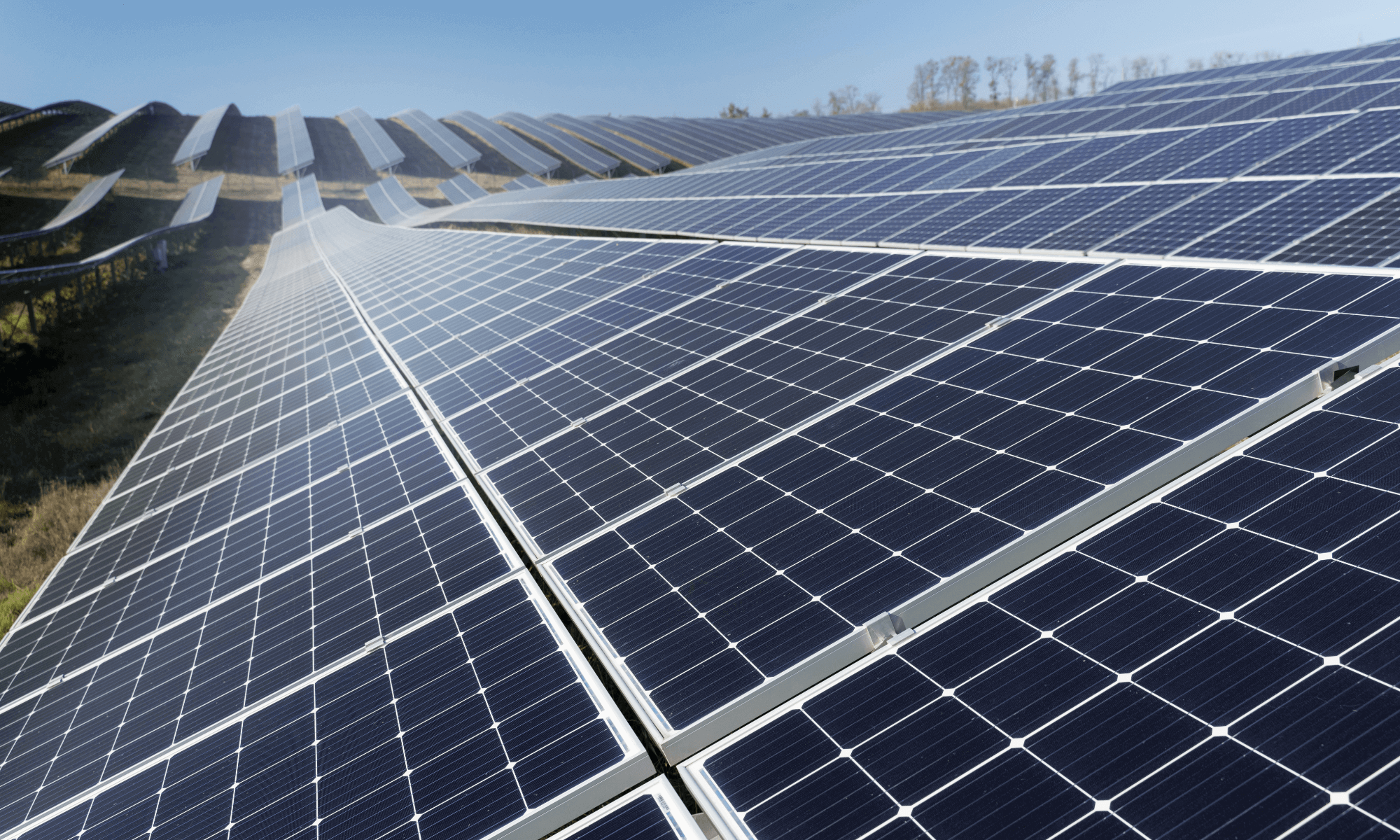

Since 2007, numerous federal programs have incentivized the adoption of clean energy technologies, like residential and commercial solar power systems.

One of the most recent is the Clean Economy Investment Tax Credit program, which includes incentives for renewable energy projects that generate electricity among other categories, including:

Carbon capture and storage

Clean technology property

Clean hydrogen

The federal government has announced $92 billion in funding for Clean Economy Investment Tax Credits through 2034…

But what exactly is the Clean Technology Investment Tax Credit, and who is eligible?

Read on to find out.

What Is the Clean Technology Investment Tax Credit?

The Clean Technology Investment Tax Credit (CT ITC) is a federal tax credit available to taxable Canadian corporations or real estate investment trusts (REIT).

The corporation or REIT can also be eligible for the CT ITC as a member of a partnership with third parties.

According to Canada Revenue Agency, “The CT ITC is a refundable tax credit for capital invested in the adoption and operation of new clean technology (CT) property in Canada from March 28, 2023, to December 31, 2034.”

Eligible applicants may receive a refundable tax credit of up to 30% of the capital cost of CT property purchased and made operational before 2033.

The CT ITC rate drops to 15% (maximum) as of 2034, and availability ends at the end of that year.

How Does It Work?

The CT ITC is designed to incentivize the expansion of Canada’s Clean Energy Economy and reduce greenhouse gas emissions to net-zero by 2050.

According to the CRA, the following Clean Technology property is eligible for the Investment Tax Credit:

Equipment used to generate electricity from solar, wind and water energy

Stationary electricity storage equipment that does not use any fossil fuel in operation (such as batteries and pumped hydroelectric storage)

Active solar heating equipment, air-source heat pumps and ground-source heat pumps

Non-road zero-emission vehicles and related charging and refuelling equipment that is used primarily for such vehicles

Equipment used exclusively for the purpose of generating electrical energy or heat energy (or a combination of both), solely from geothermal energy, unless it is part of a system that extracts fossil fuels for sale

Concentrated solar energy equipment

Small modular nuclear reactors

As you might guess, the CT ITC is geared mainly towards — but not limited to — infrastructure-level investments.

Are You Eligible for the Clean Technology Investment Tax Credit?

Individual taxpayers and households are not eligible for the Clean Technology Investment Tax Credit.

The CT ITC is only available to taxable Canadian corporations and Real Estate Investment Trusts (REITs).

It’s essential to note that the CT ITC is available to taxable corporations of any size, including small businesses.

Individual taxpayers and households may be eligible for grants and/or interest-free loans for home solar power and other clean energy systems under the Canada Greener Homes Initiative.

The Canada Greener Homes Grant application window has closed, but the Canada Greener Homes Loan is still available to eligible households.

The Canada Greener Homes Affordability Program (CGHAP) is also scheduled to become available in 2025.

Under CGHAP, low-to-median-income homeowners and tenants may be eligible for no-cost home retrofits to improve energy efficiency and reduce energy bills.

Provincial and Territorial Solar Incentives

Province or Territory | Incentive Type | Amount | Requirements | Provider |

Alberta | Net Metering | Variable | Eligible grid-tied or hybrid photovoltaic system | Multiple Options |

British Columbia | Self-Generation (Net Metering) | Variable | Eligible grid-tied or hybrid photovoltaic system | BC Hydro, Fortis |

British Columbia | Solar Panel Rebate | Up to $5,000 | - $1,000 per kilowatt (kW) of installed generator capacity. - Rebate amount capped at 50% of total installed product cost (including labour and materials). - Maximum rebate $5,000. | BC Hydro |

British Columbia | Home Battery Storage Rebate | Up to $5,000 | - $500 per kWh of installed storage capacity. - Rebate amount capped at 50% of total installed product cost (including labour and materials). - Maximum rebate $5,000 - Minimum storage capacity: 5 kilowatt-hours (kWh) | BC Hydro |

Manitoba | Net Billing | Variable | Eligible grid-tied or hybrid photovoltaic system | Manitoba Hydro |

New Brunswick | Net Metering | Variable | Eligible grid-tied or hybrid photovoltaic system | NB Power |

New Brunswick | Solar Panel Rebate | $200 per kW of rated power output | PV system compliant with NB net metering requirements | NB Power |

Newfoundland and Labrador | Net Metering | Variable |

| |

Nova Scotia | SolarHomes | Up to $3,000 in rebates for approved solar photovoltaic (PV) systems up to 10 kW | Systems must be: - Designed and installed by an Efficiency Nova Scotia Registered Solar Installer - A minimum size of 1 kW - New | Efficiency NS |

Nova Scotia | Net Metering | Variable |

| NS Power |

Ontario | Solar Panel + Home Battery Storage Rebate | Solar Photovoltaic (PV) Systems: including panels, mounting system, connection costs, and inverter(s): Up to $5000 for ($1000/kW up to 50% of total costs.) Battery Storage: ($300/kWh, up to 50% of total costs* *Net metering is NOT permitted | - Rooftop installation - New system - Purchased in Canada - Designed and installed by a licensed electrician | |

Prince Edward Island | Solar Electric Rebate Program | 1,000/kilowatt DC installed, up to 40% of installed costs, to a maximum of $10,000. | - Building must receive the residential rate on the electric bill. - Work with solar PV installer from the Network of Excellence | Solar Electric Rebate Program |

Quebec | Net Metering | Variable | Eligible grid-tied or hybrid photovoltaic system | Hydro Quebec |

Saskatchewan | Net Metering | Variable | Eligible grid-tied or hybrid photovoltaic system | SaskPower |

Yukon | Renewable Energy Rebate | Rebate of $800 per kilowatt of generating capacity to a maximum of $5,000 per system per year. | Grid-tied: Signed copy of your Micro-generation Interconnection and Operating Agreement or a final electrical inspection report. Off-grid: provide a copy of the final approved electrical inspection or a letter of assurance from a professional engineer. | Home Energy Rebates |

Yukon | Micro-generation Program (Net Metering) | Variable | New applications paused until January 2026 | Microgeneration Program |

Northwest Territories | Net Metering | Variable | Eligible grid-tied or hybrid photovoltaic system | NWT Government |

Northwest Territories | Renewable Energy Rebate | Up to $20,000 - 50% of the total eligible costs of the project - $4/watt that the system can produce | Renewable energy systems and all materials required for installing your system Shipping Inverters and electrical control systems Batteries for stand-alone applications and for grid-tied systems with battery backup | Arctic Energy Alliance |

Nunavut |

| Homeowners are eligible for a non-repayable grant of up to 50% of total project costs, up to a maximum of $30,000, whichever amount is the lesser of the two. | Receipts showing your system is paid in full, noting the supplier, the date of purchase, and itemized material costs. Photos of the installed system, including: • Solar array • Bi-directional meter • Batteries and charge controller (if installed) | Nunavut Housing Corporation |

Multiple provincial and territorial solar incentives are also available, depending on where you live.

How Much Can You Get From the Clean Technology Investment Tax Credit?

Corporations and REIT mutual funds may receive a refundable tax credit of up to 30% on the purchase and installation costs of eligible clean technology property, including solar, wind, and hydropower projects that generate electricity.

There is no fixed cap on the dollar amount available from the CT ITC.

However, overall federal budget constraints could theoretically lead to the CRA declining eligibility for a project.

Considering that the government has budgeted for a total of $93B in Clean Economy Tax Credit incentives by 2034–35, that outcome currently appears unlikely.

How to Apply

Confirm Tax Credit Eligibility: As noted above, only taxable corporations and REITs are eligible for the Clean Economy Investment Tax Credits.

Consult Natural Resources Canada For Technical Guidance: Is your business a taxable corporation or REIT that wants to purchase and install clean energy property? Contacting NRCan for technical guidance before investing is an optional — but essential — step. If you skip it, the property may be ineligible for the credit, and your business will be on the hook for all costs. You can contact NRCan via email at nrcan.class43-1-categorie43-1.rncan@canada.ca

Avoid Tax Credit Rate Reductions: Employers must meet strict labour requirements to receive the full credit rate of 30%. If you opt out of the labour requirements for workers and apprentices, the credit rate will automatically be reduced by 10%. If you opt in and are found non-compliant, there will be significant financial consequences.

Filing a Claim: The process for filing a CT ITC claim differs based on the tax structure of the business: taxable corporation, REIT mutual fund, or partnership. Corporations must file additional documentation with their T2 Corporation Income Tax Return. Learn more about the filing process here. Some investments may be eligible for the Accelerated Capital Cost Allowance (ACCA). Consult your tax preparer or accountant.

After the Claim: The CT ITC is technically a refundable tax credit, but is most frequently used to reduce corporate income taxes owed, not to receive a cash refund. Even if the amount of the credit exceeds income tax liability in the year it’s claimed, it’s common practice to apply the balance to subsequent years’ tax returns. In rare cases, a refund may be possible. Consult your tax professional for advice if you wish to receive some or all of the credit as a cash refund.

Frequently Asked Questions

How Long Does It Take To Receive the Tax Credit?

In most cases, taxable corporations, Real Estate Investment Trusts (REIT), and partnerships claim the Clean Technology Investment Tax Credit (CT ITC) by filing additional documentation with the relevant federal income tax return. The credit is applied against the business’s income tax liability for the year it’s claimed. If the credit exceeds the company’s tax liability, it’s typically rolled over and claimed in subsequent years. In rare cases, a cash refund may be issued.

Final Thoughts

Individuals and households are ineligible for the Clean Technology Investment Tax Credit, although many other incentive programs aimed at consumers are available, depending on where you live.

While no-interest loans and tax rebates are valuable incentives to install solar panels at home, it’s essential to realize that the most significant benefits of generating some or all of your electricity, financial or otherwise, come from electricity bill savings and peace of mind.

EcoFlow’s whole home generator and battery backup systems, like DELTA Pro Ultra, can help you maximize energy bill savings and keep your house up and running during power cuts and blackouts.

From off-grid power for camping and road trips to powering all your home appliances and HVAC systems, EcoFlow has a solution for you.

Check out our selection today.