Final Carbon Tax Rebate: How Much Money Do I Get?

Wondering what the carbon tax rebate means for your household? This guide explains how much you’ll get, who qualifies, and when payments arrive—plus how factors like province, family size, and rural residency affect your total. Learn how the rebate supports everyday Canadians and how to make the most of it.

How Much Will I Get From a Carbon Tax Rebate?

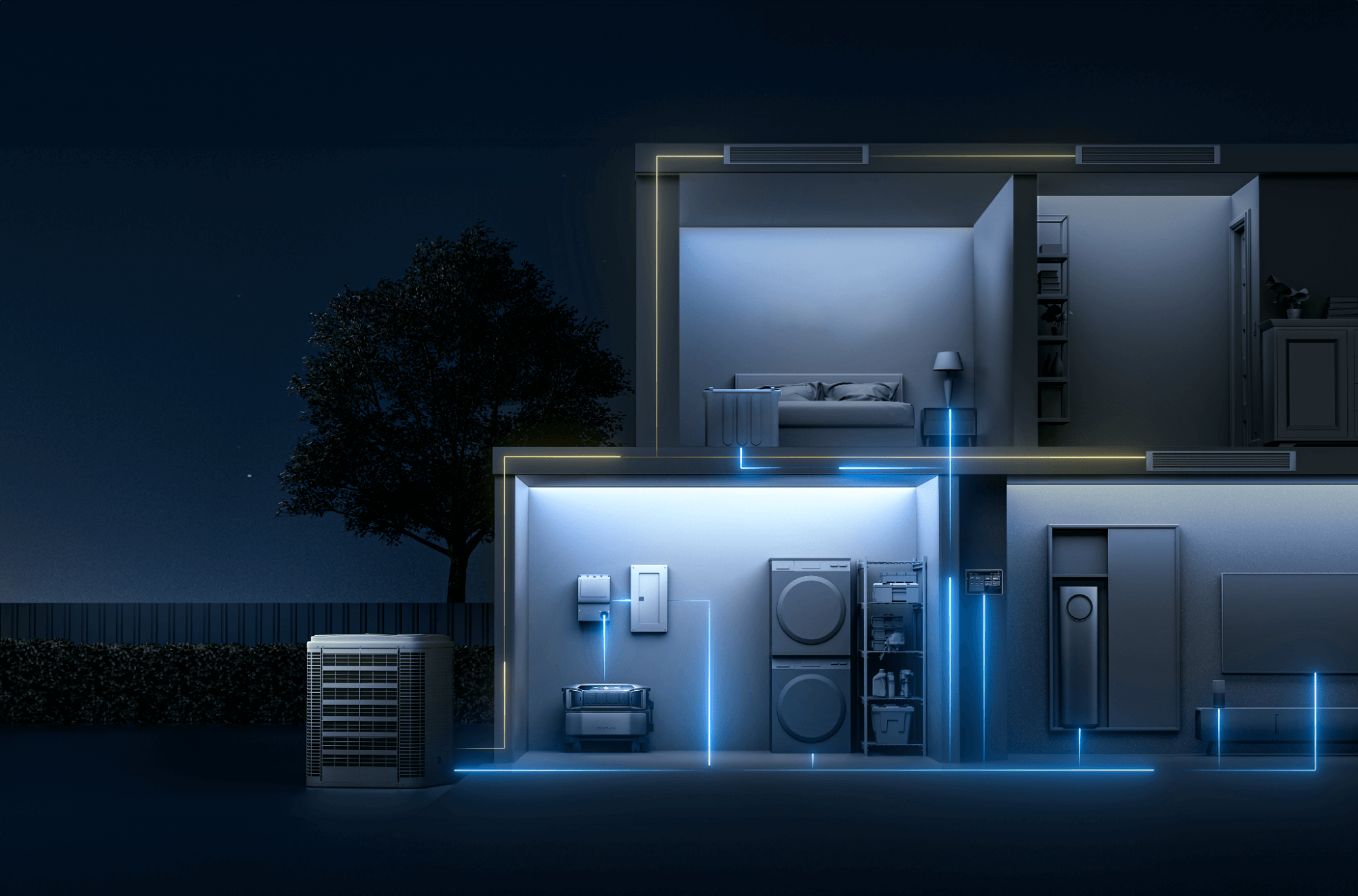

Your carbon tax rebate depends on your province, household size, and rural status. In 2024, quarterly payments like $140 for individuals help offset fuel charges. Tools like the EcoFlow DELTA 3 Plus can further reduce reliance on the grid, helping lower-energy households maximize both savings and sustainability.

What Is the Rural Supplement for Carbon Tax Rebate?

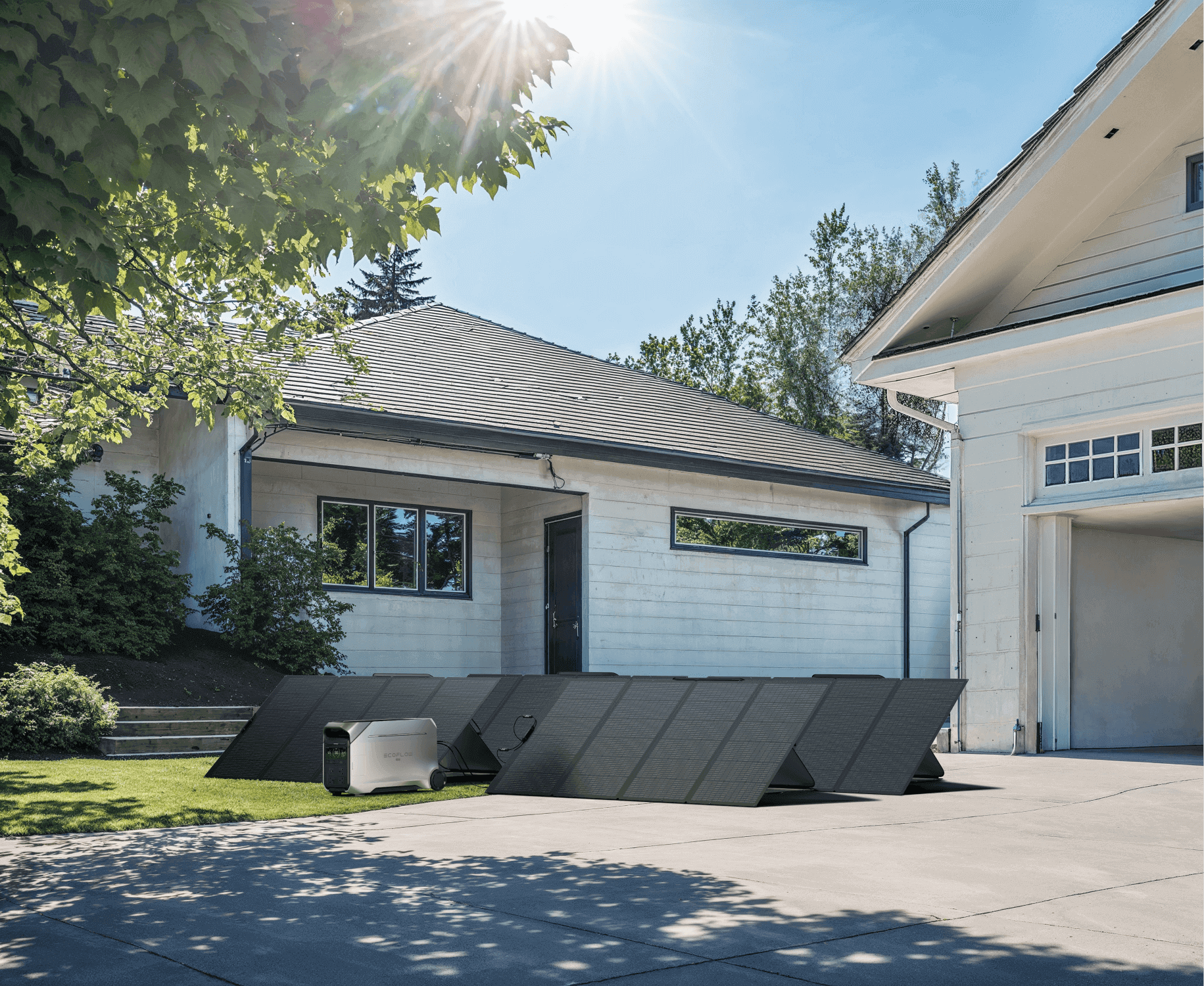

The rural supplement adds 20% to your carbon tax rebate if you live outside a census metropolitan area. It reflects higher energy costs in remote regions. Pairing the rebate with reliable off-grid gear like the EcoFlow DELTA Pro 3 can help rural households cut costs and boost energy independence.

Final Carbon Tax Rebate by Province

The amount you will receive from the tax rebate depends on your province, marital status, number of children, and whether you qualify as rural.

Following is a glance at the province and status type so you know roughly what you can expect to receive:

Alberta

Base CAIP Quarterly Amounts (2024):

Individual: $193

Spouse or common-law partner: $96.50

Each child under 19: $48.25

Family of four: $386

With Rural Supplement:

Individual: $231.60

Spouse: $115.80

Each child: $57.90

Family of four: $463.20

Ontario

Base CAIP Quarterly Amounts (2024):

Individual: $140

Spouse or common-law partner: $70

Each child under 19: $35

Family of four: $280

With Rural Supplement:

Individual: $168

Spouse: $84

Each child: $42

Family of four: $336

Manitoba

Base CAIP Quarterly Amounts (2024):

Individual: $132

Spouse or common-law partner: $66

Each child under 19: $33

Family of four: $264

With Rural Supplement:

Individual: $158.40

Spouse: $79.20

Each child: $39.60

Family of four: $316.80

EcoFlow DELTA Pro 3 Solar Generator (PV400W)

Saskatchewan

Base CAIP Quarterly Amounts (2024):

Individual: $170

Spouse: $85

Each child under 19: $42.50

Family of four: $340

With Rural Supplement:

Individual: $204

Spouse: $102

Each child: $51

Family of four: $408

Nova Scotia

Base CAIP Quarterly Amounts (2024):

Individual: $124

Spouse: $62

Child: $31

Family of four: $248

With Rural Supplement:

Individual: $148.80

Spouse: $74.40

Child: $37.20

Family of four: $297.60

New Brunswick

Base CAIP Quarterly Amounts (2024):

Individual: $92

Spouse: $46

Child: $23

Family of four: $184

With Rural Supplement:

Individual: $110.40

Spouse: $55.20

Child: $27.60

Family of four: $220.80

Newfoundland and Labrador

Base CAIP Quarterly Amounts (2024):

Individual: $164

Spouse: $82

Child: $41

Family of four: $328

With Rural Supplement:

Individual: $196.80

Spouse: $98.40

Child: $49.20

Family of four: $393.60

Prince Edward Island

Base CAIP Quarterly Amounts (2024):

Individual: $120

Spouse: $60

Child: $30

Family of four: $240

With Rural Supplement:

Individual: $144

Spouse: $72

Child: $36

Family of four: $288

British Columbia & Quebec

These provinces do not receive CAIP because they operate their own carbon pricing systems and distribute revenue separately. If you live in either province, contact your provincial government for details on carbon rebates or tax credits.

What Date Will the Carbon Tax Be Paid?

The carbon tax rebate is paid quarterly by direct deposit or cheque, depending on your tax filing preferences. For 2024, payments are scheduled for:

January 15

April 15

July 15

October 15

To receive your payment on time, you must file your previous year’s tax return. If you qualify but haven’t filed yet, your payment will be delayed until your return is processed.

Does Everyone Get Carbon Tax Rebate?

Most Canadians living in provinces where the federal fuel charge applies—like Alberta, Ontario, Manitoba, and Saskatchewan—are eligible for the rebate. However, not everyone automatically receives it. You must file a tax return, even with no income, to trigger payment. The rebate is income-tested only for certain supplements, but not the base amount.

Permanent residents, protected persons, and temporary residents meeting eligibility criteria may also qualify. Those in exempt provinces or with unfiled taxes won’t receive the payment.

Frequently Asked Questions

Do You Have To Do Your Taxes To Get Carbon Tax?

Yes. Filing a tax return is required to receive the carbon tax rebate, even if you had no income. The rebate is administered through the tax system, so no return means no payment. Once your return is processed, you’ll receive any missed quarterly payments retroactively.

How Do I Know if I Get Carbon Tax?

If you live in a province where the federal fuel charge applies and you’ve filed your taxes, you likely qualify. CRA notices or your tax return summary will indicate the rebate amount. You can also check your CRA My Account for details about your CAIP eligibility and upcoming payments.

Do Both Husband and Wife Get the Carbon Tax Rebate?

No. The carbon tax rebate is paid to one individual per household, usually the person who files first. The total amount includes portions for the spouse and children, but it’s issued as a lump sum to a single recipient. There’s no option to split the payment between partners.

Final Thoughts

The carbon tax rebate helps offset fuel charge costs for households in eligible provinces. Most Canadians receive it automatically through their tax return, with added support for rural residents. By understanding what you qualify for, you can better plan your budget and even invest in off-grid savings with tools like the EcoFlow DELTA Pro 3 Solar Generator (PV400W) for greater energy independence.