Nevada Solar Incentives: All You Need to Know in 2025

Nevada's good sunlight and helpful solar policies give it one of the best locations in the United States to make an investment in solar power. This manual breaks down the top incentives that you can use in 2025, including federal and state incentive programs. From powering a home to building a flexible off-grid system, you'll have real ways to save money and gain energy independence.

Why Solar Energy Matters in Nevada

Nevada is consistently in the top 10 states for solar opportunity. It has over 300 days of sunshine every year, so it's no wonder that the state continues to see steady solar uptake.

Besides favorable weather, there's a financial plus: electricity prices in Nevada have gone up in recent years. According to the latest data from the U.S. Energy Information Administration (EIA), as of early 2025, Nevada's average retail electricity price is 10.07 cents per kilowatt-hour, significantly lower than the national average, creating a more favorable economic environment for residents installing solar systems.

Solar systems allow homeowners to lock in the rates of today to avoid future hikes. They also reduce reliance on the utility company and increase energy independence—especially valuable in wildfire-prone or rural areas where blackouts become more common.

Federal Solar Incentives Available in Nevada

Before diving into Nevada's choices, keep in mind that the Federal Investment Tax Credit (ITC) is still the largest nationwide solar incentive.

Through 2025:

The ITC provides a 30% tax credit to eligible solar installations (Source: energy.gov)

It applies to residential and commercial systems

It includes batteries and storage systems when paired with solar

Example: A $20,000 home solar system with a battery may yield $6,000 in federal tax savings. This credit reduces your actual taxes owed, not just your taxable income. Unused portions can be rolled forward.

You can qualify whether you pay upfront or use solar loans, which gives more families access to the benefit. The ITC can also be combined with state and local programs.

Nevada-Specific Solar Incentives in 2025

While federal credits like the 30% ITC offer a solid baseline, Nevada boosts the value of going solar with several state-backed and utility-specific programs in 2025.

✅ 1. Net Metering (NV Energy – Tier 4 Rate)

Overview: NV Energy maintains one of the most important programs for residential solar users in the state: net metering. As of 2025, new residential systems are enrolled in Tier 4, which offers 75% of the retail electricity rate for all excess solar power sent back to the grid.

Key facts:

Applies to systems up to 25kW, which covers almost all home installations

Credits are calculated monthly and roll over indefinitely

Customers benefit from monthly "true-up" billing, which balances surplus summer generation against winter usage

Credits apply to the energy charge portion of your bill, not fixed service fees

Source:

NV Energy Net Metering via EnergySage

✅ 2. Renewable Energy Tax Abatement (RETA)

Overview: For large-scale solar projects—such as commercial properties, multi-home developments, or solar farms—Nevada offers major tax abatements under the RETA program.

Incentives:

Sales and Use Tax Abatement: Up to 100% exemption for 3 years

Property Tax Abatement: Up to 55% reduction for 20 years

Eligibility: Projects must meet job creation and wage requirements and receive state certification. This program is not applicable to single-home residential systems but is critical for expanding grid infrastructure.

Sources:

DSIRE:NV Sales Tax Abatement

DSIRE: NV Property Tax Abatement

✅ 3. Solar Rights Law in Nevada

Overview: Nevada law protects homeowners who want to install solar panels—even in communities governed by homeowners' associations (HOAs).

Highlights:

They may set reasonable restrictions (e.g., placement, color), but these must not significantly reduce system performance or increase cost

Homeowners can use this law as legal support in HOA disputes

This is especially useful for residents in gated communities or townhome setups.

Solar Optimum – Solar Rights in Nevada

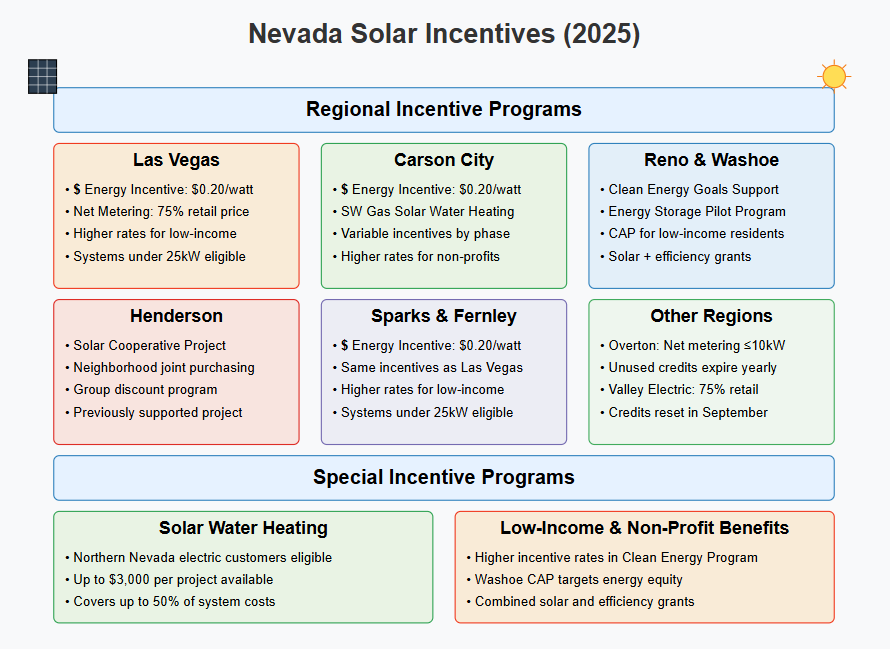

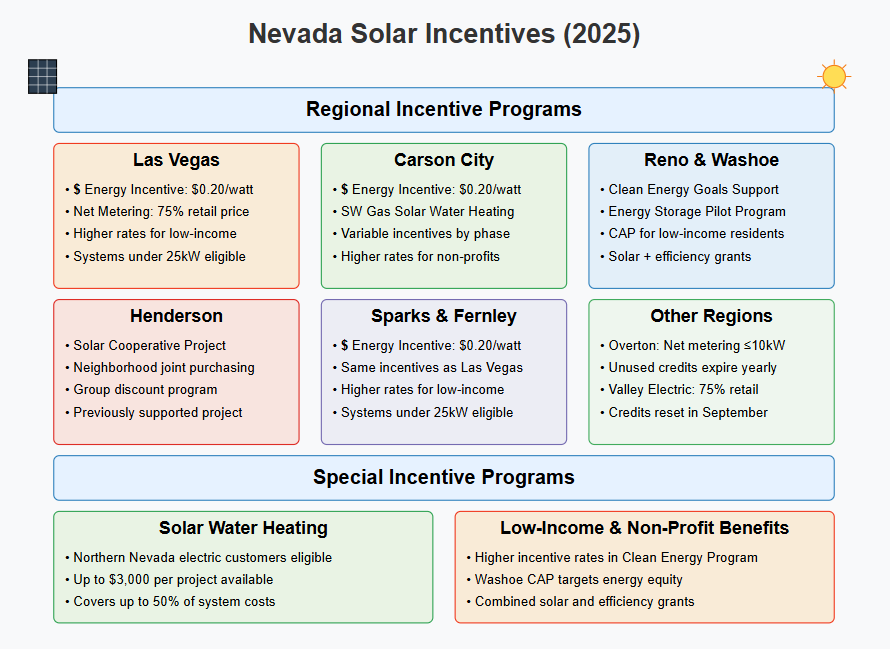

✅ 4. Local-Level Incentives (City and Utility-Based)

Some cities and utility providers in Nevada offer additional incentives beyond federal and state programs.

For example:

📍 Reno & Washoe County

ReEnergize Reno offers rebates and incentives for energy-efficient equipment like LED lighting and efficient HVAC systems

Washoe County's Climate Action Plan (2024–2025) includes grants for low-income households to adopt energy-saving measures including solar

ReEnergize Reno

Washoe County CAP PDF

*Offers vary each year—check utility websites for current availability. |

Summary Table (2025 Nevada Solar Incentives)

| Incentive Type | Description | Available To |

| Net Metering | 75% retail credit for excess solar export (Tier 4) | NV Energy residential customers |

| RETA Tax Abatements | Up to 55% property and 100% sales tax relief | Commercial & large-scale systems |

| Solar Access Law | HOA rules must not hinder solar installations | All Nevada homeowners |

| Local Rebates | Rebates or grants from cities/utilities | Reno, Washoe County, rural areas |

What Kind of Setup Is Right for You?

Different lifestyles call for different solar setups—and Nevada's incentives work across all of them:

- Homeowners benefit from rooftop solar plus batteries for lower bills and blackout backup

- Cabin or rural users often need off-grid systems with larger storage banks

- Renters or RV owners may prefer portable, modular kits with expandable battery capacity—no roof needed

Even homes without roof access can use ground-mounted systems or solar stations on adjacent property to qualify for incentives.

EcoFlow: A Clever, Scalable Solar Answer for Nevada Users

Many people want solar power without long wait times, roof work, or costly permitting. This is where EcoFlow steps in—offering smart, portable systems that meet energy needs without installation delays.

Why EcoFlow Fits Nevada:

Store 2kWh to 25kWh using modular battery add-ons

Pair with 400W solar panels for fast daytime charging

Integrate with home circuits via Smart Home Panel

Charge from solar, grid, or EV station

Control via the EcoFlow App (e.g., time-of-use rate savings)

No roof access? No problem:

Most EcoFlow setups don't require permits

Easy to install for seasonal, rental, or mobile use

Qualifies for the 30% federal tax credit when solar panels are included

Can work alongside existing rooftop systems as a battery backup

Operates quietly—ideal in cities or wildfire zones

Example Use Cases:

A Las Vegas homeowner pairs DELTA Pro with solar panels and saves 30% via ITC

A Reno cabin runs off-grid with EcoFlow + panels to skip utility hookup costs

A Henderson family uses DELTA 2 Max during hot summer months to offset peak cooling bills

EcoFlow DELTA Pro Solar Generator (PV400W)

Nevada Solar: Make Your Move

Nevada continues to offer one of the most solar-friendly environments in the country. Between strong sunlight, federal tax credits, and state-level policies like net metering, going solar makes real financial sense. Whether you're installing a rooftop array or choosing a portable option like EcoFlow, the 2025 incentives are structured to support your switch to clean energy.

FAQ: Nevada Solar Incentives 2025

Q1: Which Nevada cities have the longest wait times for rooftop solar installations?

Urban centers like Reno and Las Vegas have longer wait times in 2025 due to high demand and lower contractor availability. Home owners can have scheduling delays of 1–3 months for peak seasons. Portable or modular systems offer faster setup without professional help.

Q2: Do I need to use a certified installer to claim the federal tax credit?

Yes, solar systems must be professionally installed for the solar system to be eligible for the 30% tax credit. Self-installed units like EcoFlow are acceptable if paired with compliant panels and used as a primary or supplemental source of power on the property. Always save receipts and installation records for tax purposes.

Q3: Is there a deadline for the 30% federal tax credit?

The 30% credit is assured through 2032 under present policy.

Nevertheless, it makes sense to get on with it, as policy can turn on you.

Equipment needs to be installed and running in order to qualify any given tax year.

Q4: Do I need a south-facing roof to install solar panels?

South-oriented roofs are optimal but not required. Panels are also placed on east- or west-oriented roofs or in the backyard. Orientation has an effect on output but not certification.

Q5: Are solar batteries worth it in Nevada?

Yes. Solar batteries stabilize peak hour rates, provide blackout protection, and enable the storage of sunlight for use at night. With increasing frequency of summer blackouts and wildfires, batteries are being added to almost every home in Nevada as protection to electricity