Incentives for Solar Panels: Maximize Savings with EcoFlow Solar Power Systems

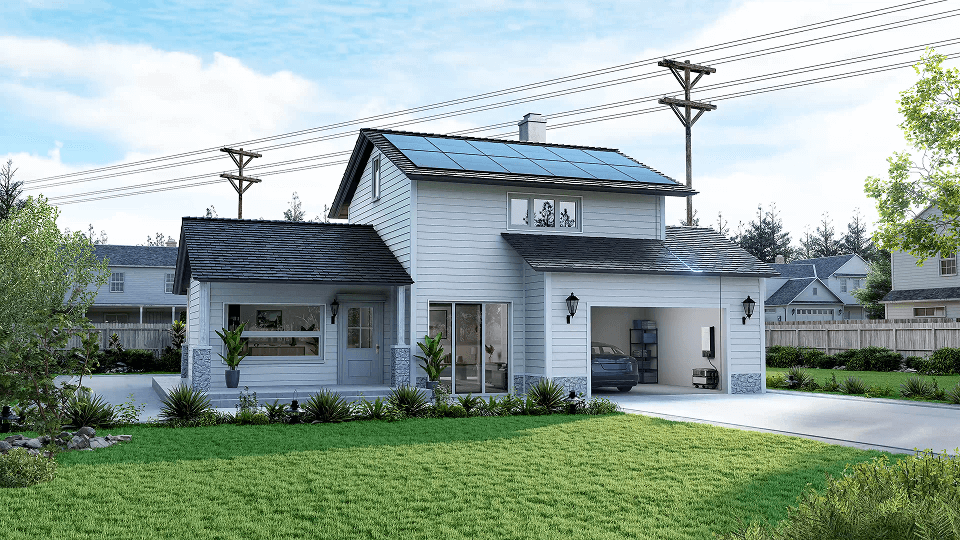

If you’re considering installing solar panels to generate a portion — or all — of your household electricity, there’s never been a better time to make the switch.

Recent years have seen significant innovations in solar panel and battery storage technology, coupled with substantial reductions in price.

Generous solar incentives from the federal, state, local governments and utility companies can further offset your upfront cost — typically by at least 30% and often considerably more.

As a leader in residential solar and home battery power, EcoFlow offers multiple award-winning systems that qualify for tax credits and other incentives, in addition to reducing (or eliminating) your electricity bills.

Learn how to reduce your reliance on aging utility grid infrastructure, futureproof your home against power outages, and take advantage of all the available incentives to reduce your initial solar investment.

Types of Solar Incentives

In the US, federal, state, and local governments, utilities, and power companies offer many different types of solar incentives.

Here’s a comprehensive list.

Federal Income Tax Credits

Net Metering

Federal Tax Rebates

Federally Funded State and Local Programs (i.e. Solar For All)

State Rebates

State Property Tax Credits

State Income Tax Credits

Sales Tax Exemptions

Community Solar Programs

Solar For All Programs

Performance-Based Incentives (PBIs)

Low or No-Interest Loans

Local Solar Incentives

Renewable Energy Certificates (RECs)

In many cases, you can stack multiple incentives to significantly reduce the purchase and installation costs of eligible residential photovoltaic (PV) modules — like solar panels — and the balance of system components required for off-grid, grid-tied, or hybrid solutions, including home battery storage.

Here’s how to save on your solar switch.

Residential Clean Energy Credit

Popularly known as the Federal Solar Tax Credit, the Residential Clean Energy Credit can save US homeowners 30% off the total purchase and installation costs of solar panels and home backup battery systems.

For most homeowners, rooftop photovoltaic systems that generate electricity from sunlight are the most viable clean energy property, but other systems are also eligible for the credit, including:

Solar electric panels and balance of system components

Small wind energy turbines

Geothermal heat pumps

Fuel cells

Battery storage technology of 3 kilowatt-hours (kWh) capacity or above.

Other qualified expenses may include:

Labor and installation costs

Cables, mounting hardware, and wiring

The Residential Clean Energy Credit is by far the most generous solar incentive currently available from federal or state governments.

EcoFlow Products Eligible for the Residential Clean Energy Credit

If you meet the personal eligibility requirements for the Residential Clean Energy Credit, you can save 30% on the purchase and installation costs of the following EcoFlow products.

EcoFlow DELTA Pro Ultra

EcoFlow DELTA Pro 3

EcoFlow DELTA Pro

EcoFlow DELTA 2 Max (with additional Smart Extra Battery)

EcoFlow Solar Panels

EcoFlow Smart Extra Batteries (if the total system storage capacity exceeds 3kWh).

As an example of what you can save, the EcoFlow DELTA Pro Ultra is a whole-home backup generator system that starts with the following specs.

7.2kW of AC Output (10.8kW surge power)

6kWh of home backup storage

5.6kW of solar charge input (up to 14 x 400W solar panels)

Here are your potential savings under the Residential Clean Energy Credit based on current direct-from-manufacturer pricing.*

Product | Retail Price | 30% Tax Credit Savings |

|---|---|---|

$4,899 | $1,470 | |

6 x 400W Solar Panels | $1,999 | $600 |

Installation and Wiring | $600 | $180 |

Total | $7,498 | $2,250 |

With the 30% solar tax credit, the total purchase and installation costs of $7,498 are reduced by $2,250, resulting in a net cost of $5,248 — substantial savings that can significantly reduce your solar payback period.

One crucial benefit of many EcoFlow solar generators is their modular expandability.

EcoFlow DELTA Pro Ultra is available in multiple configurations, with a maximum of 21.6kW of AC output and 90kWh of storage — enough to power almost any home.

The Residential Clean Energy Credit has no cap, enabling you to save the full 30% credit on a system customized to power all your home appliances and HVAC systems with enough battery storage capacity for up to a month off-grid.

Below are some sample configurations along with how much you can save.

EcoFlow DELTA Pro Ultra + Solar Panels (Configuration 1) | |||||

Component | Quantity | AC Output/Storage Capacity | Price Per Unit | Combined Cost | 30% Tax Credit Savings |

EcoFlow DELTA Pro Ultra (Inverter + Battery) | 1 | 7.2kW/6kWh | $4,899 | $4,899 | $1470 |

400W Solar Panels | 4 | 1,600W (Rated Power Output) | Bundled | $1,399 | $420 |

Total |

| 7.2kW/6kWh |

| $6,298 | $1,890 |

EcoFlow DELTA Pro Ultra + Solar Panels (Configuration 2) | |||||

Component | Quantity | AC Output/Storage Capacity | Price Per Unit | Combined Cost | 30% Tax Credit Savings |

EcoFlow DELTA Pro Ultra (Inverter + Battery) | 2 | 14.4kW/12kWh | $5,799 | $11,598 | $3,480 |

EcoFlow DELTA Pro Ultra Home Backup Battery | 2 | N/A | $2,999 | $5,998 | $1,800 |

400W Solar Panel | 12 | 4,800W | Bundled | $3,998 | $1,200 |

Total |

| 14.4kW/24kWh |

| $23,590 | $6,480 |

EcoFlow DELTA Pro Ultra + EcoFlow Smart Home Panel 2 + Solar Panels (Configuration 3) | |||||

Component | Quantity | AC Output/Storage Capacity | Price Per Unit | Combined Cost | 30% Tax Credit Savings |

EcoFlow DELTA Pro Ultra (Inverter + Battery) | 3 | 21.6kW/18kWh | $4,899 | $14,677 | $4,403 |

1 | N/A | $1,599 | $1,599 | N/A | |

EcoFlow DELTA Pro Ultra Home Backup Battery | 12 | 72kWh | Bundled | $81,684 | $24,505 |

400W Solar Panel | 24 | 9,600W | Bundled | $7,497 | $2249 |

Total |

| 21.6kW/90kWh |

| $105,637 | $31,157 |

It’s essential to note that the Residential Clean Energy Credit is non-refundable.

If your eligible savings under the Credit exceed your federal income tax liability for the year you install the system, you can roll the balance over to subsequent tax years.

If you don’t owe income taxes in the year of installation, you can claim the credit in the subsequent year.

However, if the amount of the credit exceeds your tax liability, you won’t receive a refund check from the IRS for the balance.

If you don’t pay federal income taxes at all, you’re ineligible for the credit.

With a few exceptions, taking the Residential Clean Energy Credit (RCEC) doesn’t disqualify you from state solar incentives and rebates, and there’s no limit to how many times you can claim the RCEC for new purchases until the program expires in 2032.

Ensure you take advantage of every available program to maximize your savings and solar return on investment.

Net Metering

In most parts of the US, grid-connected residential solar power systems are eligible for net metering programs through their electricity provider or power company.

Net metering is a billing mechanism in which homeowners and businesses sell a portion of the electricity their systems generate to their utility provider.

During peak sunlight hours, residential solar panel systems may generate more power than the household consumes.

Excess electricity is fed into the grid through direct connection to the utility grid with a solar inverter and a bidirectional or “smart” meter.

Typically, you’ll receive a credit on your electricity bill in cents per kilowatt-hour (¢/kWh) for the power you transmit to your utility provider each month; however, other billing arrangements do exist.

It’s essential to recognize…

On-grid solar panel systems are designed to supplement — not replace — utility power.

Solar panels don’t work at night, and photovoltaic generation potential is significantly reduced in the early morning, evening, and on cloudy days.

Almost invariably, you’ll consume more utility grid power than your solar panels produce.

Additionally, utilities charge a higher rate in ¢/kWh for the electricity they supply than they pay for the power you produce.

More crucially, for many…

Grid-tied photovoltaic systems without storage DO NOT work during a blackout.

If you’re concerned about home energy security, you need to know that a grid-connected PV system without a solar battery automatically shuts down when grid power is interrupted and remains offline for the duration of the outage.

For many homeowners, that’s a dealbreaker…

But even if it’s not, incorporating home battery storage in a hybrid PV system increases self-consumption and maximizes savings over time.

A whole home solar generator system like EcoFlow DELTA Pro 3 is a wiser investment over time than relying on net metering from your utility company to reduce your electricity bills.

EcoFlow Products Eligible for Net Metering

EcoFlow’s portable and mountable solar panels use pure monocrystalline to achieve industry-leading efficiency ratings as high as 25%

A PV module’s efficiency rating is a specific metric that measures how much direct current (DC) electricity (in watts) a solar panel can produce per square meter under ideal laboratory conditions that simulate direct peak sunlight (equal to 1000 Watts/m²).

Standard Test Conditions for Solar Panels

Condition Type | Standard Test Condition | Real-World Conditions |

Solar Incident Angle | Always zero, irradiation beam always normal to the PV panel* | Variable, and depends on time, date, and site latitude. In the case of rooftop systems, roof orientation, and inclination govern system capacity. |

Solar Irradiation | Always equal to 1000 Watts/m²* | Variable and depends on the time, date, and site latitude. Limited sunshine hours bound system capacity. |

Ambient Temperature | Always 25°C* | Variable and depends on the time, date, weather condition, and site latitude. Higher ambient temperature degrades PV panel efficiency and reduces system output. |

Air Mass Coefficient (AM) | Always equal to 1.5* | Variable and depends on the time, date, and site latitude. Higher AM with higher latitudes. |

System Losses | Always Zero* | Variable and depends on the design and location of PV panels, inverter, and grid meter. |

*Cannot be achieved in real-world operation (Source: ResearchGate)

All reputable solar panel manufacturers use identical Standard Test Conditions to measure the performance of PV modules, including crucial specs like rated power wattage and efficiency.

There are different types of solar panels, but over 90% of PV modules worldwide use crystalline silicon as the primary photovoltaic material.

(Source: ASES)

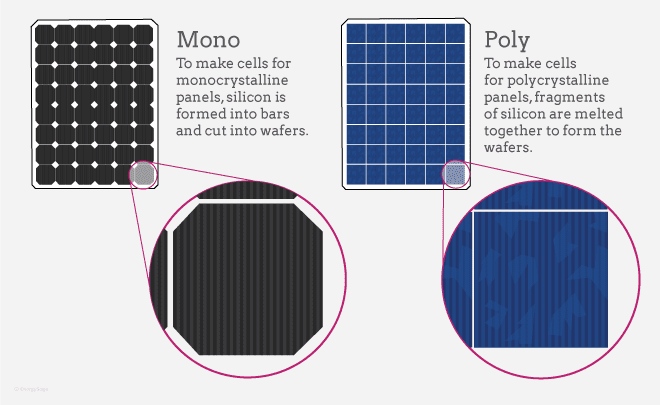

There are two types of silicon used to make photovoltaic cells.

Monocrystalline and polycrystalline.

Polycrystalline solar panels use fragments of silicon melted together as bars and cut into wafers as the primary photovoltaic material.

The silicon wafers used in monocrystalline solar cells are cut from a single crystal ingot of lab-grown silicon, offering higher efficiency and better performance.

Poly solar panels typically offer 15% to 18% efficiency ratings, while mono PV modules have ratings up to ~25% — an increase of +/- 66%.

Polycrystalline solar panels also tend to be cheaper, but over time, the increased efficiency of monocrystalline solar panels tends to outweigh the higher upfront costs.

Because you can generate more electricity per square meter, high-efficiency PV modules are ideal for rooftop installations with limited space.

(Source: Energy.ca.gov)

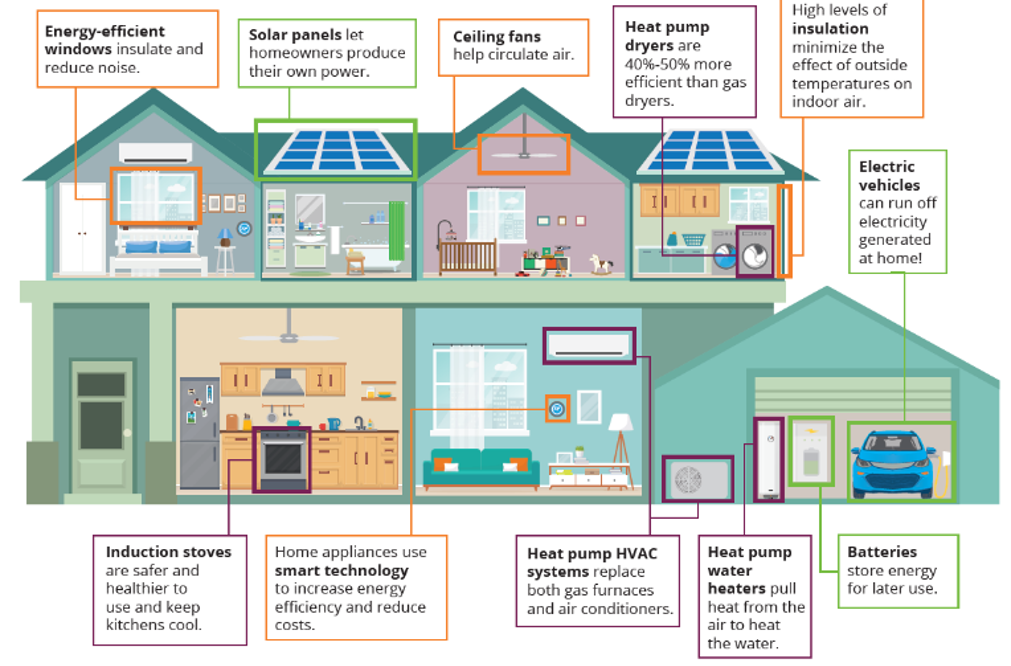

Energy Efficient Home Improvement Credit

The Energy Efficient Home Improvement Credit is another federal government program that can save you money on residential energy property and renovations that reduce your electricity and heating bills.

Additionally, you may qualify for a Home Energy Audit Tax Credit to help cover the costs of a professional assessment and recommended efficiency improvements.

According to Energy Star, the following upgrades are eligible for the Energy Efficient Home Improvement Credit from 1/1/2023 until 12/31/2032.

Heat Pump Water Heaters

Heat Pumps

Biomass Stoves/Boilers

Insulation

Windows/Skylights

Exterior Doors

Central Air Conditioners

Natural Gas, Oil, Propane Water Heaters

Natural Gas, Oil, Propane Furnaces/Boilers

Electric Panel Upgrades

Home Energy Audits

EcoFlow Products Eligible for the Energy Efficient Home Improvement Credit

EcoFlow has yet to release residential energy products that qualify for the Energy Efficient Home Improvement Credit.

But making your home more energy efficient helps maximize your ROI from solar power and home battery backup systems.

A qualified Home Energy Auditor can also advise you on how best to save on energy bills with solar panels and portable power stations that are eligible for the Residential Clean Energy Credit.

Solar For All Grants

Solar for All is a federal grant program that aims to increase access to solar power in low-income households and communities.

Unlike the other government solar incentives outlined above, Solar for All grants are administered at the state or local level, and the details of each program vary significantly.

Under the Greenhouse Gas Reduction Fund, the Environmental Protection Agency awarded $7 billion in total funding to 60 Solar For All grant recipients across the US.

“For the first time in history, low-income and disadvantaged communities in every state and territory - as well as Tribes across the country - will have access to affordable, resilient, and clean solar energy.

90% of grant recipients plan to fund residential rooftop solar.

88% of grant recipients plan to fund the deployment of residential-serving community and shared solar through diverse ownership models that enable households in disadvantaged communities to access the additional economic benefits of asset ownership.

78% of grant recipients plan to fund storage solutions, maximizing residential rooftop and residential-serving community solar deployment, increasing the resilience of the power grid, and delivering electricity to vulnerable communities during grid outages.”

Grant recipients were announced in April 2024, but the details of many programs— including eligibility and benefits — have yet to be confirmed.

For example, the Solar For All Massachusetts program has committed to publishing details by September 2025.

Other recipients, like Illinois Solar For All, have already announced the launch and eligibility requirements for residential photovoltaic and community solar programs under the grant.

You can find the complete list of Solar For All grant recipients here.

Alternatively, just Google “Solar For All” + the state or territory where you live.

State Solar Incentives

According to the Solar Energy Industry Association (SEIA), every state in the US offers some form of solar incentive…

Whether that’s tax rebates for solar panels or net metering (or both) varies significantly by state.

In most cases, you can receive state solar incentives without impacting your eligibility for the 30% Federal Solar Tax Credit.

Stacking multiple incentives can maximize your savings and minimize upfront costs.

Here is an example of state solar incentives in California.

California Solar Incentives

With abundant sunshine year-round, California has led the US in solar power production by megawatt-hours (MWh) for years.

The Golden State has also long been a leader in offering residential solar incentives, including tax rebates, property tax exemptions, and net metering programs.

Recent changes to net metering rules (NEM 3.O) have made new grid-tied residential solar panel installations less viable by significantly reducing the ¢/kWh rates paid by investor-owned utilities to many homeowners by 75%.

Meanwhile, hybrid solar + storage systems have become even more viable thanks to the Self-Generation Incentive Program, which offers a $150 rebate per kWh of solar battery storage with higher rebates of up to $1000/kWh if you meet specific eligibility requirements.

Learn more about California Solar Incentives here.

EcoFlow Products Eligible for State Solar Incentives

Eligibility varies widely by state, but EcoFlow DELTA Series solar generators and rigid solar panels frequently qualify for a variety of incentives, including rebates, tax credits, property tax exemptions, and more.

Frequently Asked Questions

What State Has the Best Solar Incentives?

California was once the hands-down leader in residential solar incentives, but with the reduction in net metering rates under NEM 3.0 throughout much of the state, it’s no longer the clear winner. New York’s NY-Sun Initiative and 25% NYS solar tax credits (up to $5,000) make it a solid contender. The federal Residential Clean Energy Credit is available nationwide and remains the most generous solar incentive for homeowners.

Final Thoughts

Government programs like the Residential Clean Energy Credit play a crucial role in encouraging homeowners to embrace electricity generation from renewables…

Still, the best incentive for switching to solar is the mid-to-long-term return on investment you can achieve through maximizing savings on electricity bills.

If you opt for an off-grid or hybrid whole-home solar generator like EcoFlow DELTA Pro Ultra, you’re also investing in the peace of mind you’ll get from knowing your family is prepared for blackouts — even during extended power outages.

EcoFlow has a wide variety of solar power and battery storage solutions for everything from camping to powering your entire home.

Check out our selection today.

*Pricing is current as of 4/28/2025 and subject to change without notice.

Solar Panels

For press requests or interview opportunities, reach out to our media team

media.na@ecoflow.com